Research Alibaba: Empire: Growth or Illusion?

Alibaba Group is a Chinese multinational technology corporation founded in 1999 by Jack Ma. The company started as an e-commerce platform, and today is one of the largest global players, spanning e-commerce, cloud computing, digital finance and entertainment sectors. Its main platforms, Taobao, Tmall and Alibaba.com, form a comprehensive e-commerce ecosystem that supports millions of Chinese businesses and consumers.

With Ant Group (and the Alipay app), Alibaba is revolutionizing digital finance in China, offering a payment system and a wide range of financial services. Alibaba Cloud, on the other hand, is China’s largest cloud computing provider, supporting the development of the country’s technology sector.

International expansion, including the acquisition of Lazada, is strengthening the company’s position in Southeast Asian markets, while investments in digital media and entertainment (including Youku Tudou, Alibaba Pictures) are expanding its influence in the entertainment industry. At the same time, Alibaba is facing regulatory challenges in China, which has affected Ant Group’s stalled IPO.

Alibaba Group remains one of the largest global technology players, with a strong presence in China and growing influence in international markets.

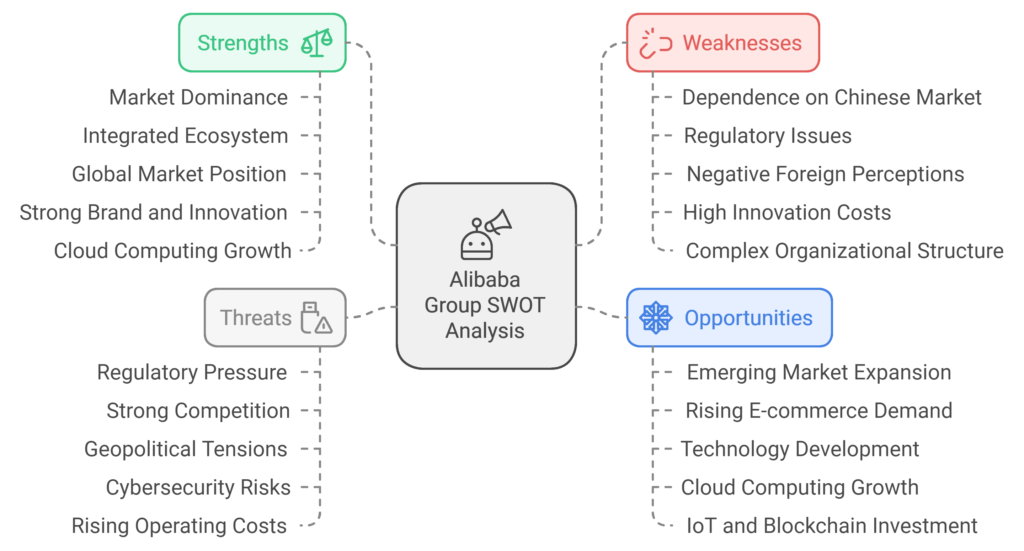

SWOT Analysis

Strengths

Dominance in China’s e-commerce market

Alibaba is the leader in China’s e-commerce market, with a huge user base and years of experience. With its flagship platforms Taobao and Tmall, the company attracts millions of customers, capturing more than 50% of China’s e-commerce market share, giving it a significant competitive advantage.

Strong e-commerce ecosystem and integrated services

Alibaba has built a comprehensive ecosystem covering all stages of the e-commerce value chain: from commerce platforms and logistics (Cainiao Network), to payment services (Alipay and Ant Group), to the cloud (Alibaba Cloud). This integrated approach allows the company to efficiently manage transactions and serve customers, increasing its operational efficiency and flexibility.

Significant position in the global market

Alibaba is investing in growth in overseas markets, particularly in Southeast Asia, through acquisitions such as Lazada. The company is also active in the logistics industry and the cloud services market, increasing its share and importance in the international e-commerce and technology market.

Strong brand and innovation

As one of China’s most recognizable technology brands, Alibaba enjoys a high level of trust in China and growing popularity in international markets. The company is constantly investing in new technologies such as artificial intelligence, big data and IoT, enabling it to create advanced and cutting-edge solutions.

Growth of the cloud computing sector

Alibaba Cloud is the largest cloud computing provider in China and the fourth largest in terms of global market share. As demand for cloud services grows, Alibaba stands to benefit from further expansion in this sector, attracting customers from both China and abroad.

Weaknesses

Strong dependence on the Chinese market

Most of Alibaba’s revenue comes from China, making the company highly vulnerable to local economic and political changes. This dependence limits the company’s ability to diversify its revenue and makes it more vulnerable to Chinese regulations.

Regulatory problems and government scrutiny

In recent years, Alibaba has faced challenges from Chinese regulations, including scrutiny of Ant Group’s operations and heavy financial penalties. These actions by the Chinese government have weakened the company’s image and limited its opportunities in the digital finance sector.

Negative perceptions in foreign markets

Alibaba has faced problems in some countries due to perceptions of Chinese technology companies as potential security threats. Concerns about data protection and ties to the Chinese government can affect the company’s perception in foreign markets and limit its expansion opportunities.

High investment in innovation and technology

Facing stiff competition from Amazon, JD.com and other tech giants, Alibaba has to invest heavily in technology development, which puts a strain on its operating budget. Heavy investment in innovation can affect profit margins, especially in competitive overseas markets.

Complex organizational structure

Due to the wide diversification of its operations and numerous subsidiaries (e.g. Ant Group, Cainiao Network), Alibaba’s organizational structure is complex and can be difficult to manage. This can lead to operational problems and difficulties in quickly adapting to market changes.

Opportunities

Expansion into emerging markets

Alibaba has huge growth potential in emerging markets such as Southeast Asia, Latin America and Africa. By investing in these regions, the company can gain new customers and diversify its revenue streams outside China, which will reduce its dependence on the domestic market.

Rising demand for e-commerce and digital payments

Growth trends in the e-commerce and digital payments sector are supporting the development of Alibaba’s ecosystem, particularly Alipay. The development of cashless transactions and the increase in confidence in online shopping worldwide are supporting the company’s expansion.

Development of technology and artificial intelligence

Alibaba can use artificial intelligence and big data to optimize logistics, personalize purchases and improve customer service. This not only increases operational efficiency, but also improves service quality, which can attract new users.

The rise of cloud computing

The growing need to digitize and store data in the cloud gives Alibaba Cloud an opportunity to expand its global market share, especially among small and medium-sized businesses and corporations looking for more affordable cloud services.

Investment in new sectors like IoT and blockchain

Alibaba is researching and developing technologies in the Internet of Things (IoT) and blockchain, which gives it an edge in innovation and potentially new sources of revenue. IoT has broad applications in logistics, manufacturing and smart cities, which could make Alibaba’s business more efficient.

Threats

Chinese government regulation and regulatory pressure

The Chinese government is increasingly controlling the technology sector, which is affecting the operations of companies such as Alibaba. Regulations being put in place may affect Alibaba’s business model, particularly in the financial and cloud services sectors.

Strong local and global competition

In China, Alibaba has to compete with JD.com and Pinduoduo, while in international markets it has to compete with Amazon, Google and Microsoft. Competition forces investment in technological development and can affect profit margins.

Geopolitical conflicts and trade tensions

Trade tensions, particularly between China and the United States, could hurt Alibaba’s international operations, causing restrictions on access to technology and foreign markets.

Threats related to cyber security and data protection

As a global provider of digital services, Alibaba is at risk of cyber attacks and requires heavy investment in data security. In the event of security breaches, the company’s reputation could suffer, and the financial consequences could be significant.

Rising operating costs and inflation

Rising operating costs, especially in areas such as logistics and transportation, can negatively affect Alibaba’s profit margins. Inflation is affecting the cost of materials, wages and services, adding pressure to the company’s operating budget.

In summary, Alibaba Group is one of the strongest and most innovative technology corporations in the world. With an integrated ecosystem of services and a strong foothold in the Chinese market, Alibaba can successfully compete in the e-commerce and cloud services sectors. The company is betting on expansion into international markets and further development in the high-tech sector. However, Alibaba’s future will largely depend on its ability to cope with regulatory challenges, intense competition and rapidly changing geopolitical and economic conditions.

Competitor analysis

Alibaba Group is one of the world’s largest technology companies, but it faces strong competition in each of its key sectors. The rivalry mainly covers the areas of e-commerce, cloud computing, digital payments and logistics services. Alibaba’s biggest competitors are both Chinese companies, which pose a challenge in its home market, and global giants with whom Alibaba competes internationally.

Competition in China’s e-commerce market

JD.com

JD.com is Alibaba’s biggest rival in China’s e-commerce market. The company offers a wide range of products and, with its own extensive logistics infrastructure, enables deliveries within China even within a day. JD.com differs from Alibaba in that it operates its own warehouses and controls much of the delivery process, allowing it to better control the quality of service and delivery. This strengthens its position in the premium and technology products sector, where speed of delivery and quality of service are key.

Pinduoduo

Pinduoduo is a company founded in 2015 that has captured a significant share of China’s e-commerce market in a short period of time. The platform uses a “social commerce” model, encouraging users to buy together in groups, which allows for greater discounts. Pinduoduo has become very popular, especially in smaller cities and rural areas, offering products at lower prices than Alibaba and JD.com. This strategy proved successful and allowed the company to quickly gain a large customer base.

Xiaomi and WeChat Mini Programs

Xiaomi, a popular consumer electronics brand, is developing its own sales ecosystem that competes with Alibaba’s platforms for electronics and IoT devices. WeChat (owned by Tencent), on the other hand, has introduced “Mini Programs” that allow users to make purchases directly from the WeChat app. This gives Tencent an advantage, as WeChat is one of the most popular apps in China, making it easier to reach millions of customers.

Competition in the international e-commerce market

Amazon

Amazon is Alibaba’s biggest competitor internationally. Its advantage stems from its extensive logistics, huge user base and a wide range of services, such as Amazon Prime. In Western countries, Amazon is the dominant player, and its logistics infrastructure and cloud services allow it to successfully compete with Alibaba on a global level. Amazon is also actively expanding in Asia, where it is vying for the e-commerce market with Alibaba, particularly through India’s Amazon.in.

eBay

Although eBay is no longer as strong as it once was, it is still a competitor to Alibaba, especially in European and American markets. As a platform based on a consumer-to-consumer (C2C) model, eBay competes directly with Alibaba’s Taobao in consumer sales, offering mainly used and unique products.

Sea Group (Shopee)

Shopee, which is part of Sea Group, is Alibaba’s biggest competitor in Southeast Asian markets. The platform is growing rapidly and gaining a lot of popularity, especially in countries such as Indonesia, Malaysia, Thailand and Vietnam, where e-commerce continues to grow. Alibaba, which owns a stake in Lazada, competes directly with Shopee in the region, but Shopee has aggressive pricing and marketing policies, making it an attractive alternative for customers in the region.

Competition in the cloud computing market

Amazon Web Services (AWS)

AWS is a global leader in cloud services and Alibaba Cloud’s main competitor in the international market. AWS offers a wide range of services, from data storage to artificial intelligence, and has a huge technological advantage and experience. Amazon Web Services has a dominant position in North America, Europe and developed markets, making it difficult for Alibaba Cloud to gain significant market share in these markets.

Microsoft Azure

Microsoft Azure is the second largest cloud provider in the world and a competitor to both AWS and Alibaba Cloud. Microsoft has strong relationships with enterprise customers, giving it an edge in professional and industrial markets. As a trusted provider, Azure is a strong competitor to Alibaba Cloud, especially in the enterprise sector and public organizations.

Google Cloud Platform (GCP)

Google Cloud Platform’s focus on cloud and data services, including machine learning and artificial intelligence, makes it a significant rival to Alibaba Cloud. Google is trying to capture the global market by developing cloud services for businesses and the public sector, but also, like Microsoft Azure and AWS, has a strong presence in North America and Europe.

Tencent Cloud and Huawei Cloud

In the Chinese market, Alibaba Cloud competes with Tencent Cloud and Huawei Cloud. Tencent Cloud has strong ties to the WeChat platform and offers a wide range of services to Chinese customers, including locally tailored solutions. Huawei Cloud, on the other hand, is growing rapidly, especially in the public sector and developing countries, which poses a significant challenge for Alibaba Cloud in Asia and other regions.

Competition in digital payments

WeChat Pay

WeChat Pay, part of the Tencent ecosystem, is Alipay’s biggest competitor in China’s digital payments market. Thanks to its integration with the popular WeChat app, WeChat Pay has a huge user base and is the preferred payment method in many sectors, including retail, entertainment and services.

Apple Pay, Google Pay and Samsung Pay

In international markets, Alipay competes with global giants such as Apple Pay, Google Pay and Samsung Pay. These digital payment systems are gaining popularity, especially in developed countries, offering mobile payments that are convenient and widely accepted. Although Alipay has gained popularity outside of China, especially in Asian countries and places frequented by Chinese tourists, in many markets Apple Pay and Google Pay have an advantage due to greater brand recognition and adaptation to local markets.

PayPal

PayPal is an international leader in online payments that offers a wide range of services to consumers and businesses around the world. In regions where Alipay is just developing, PayPal is a strong competitor, especially in Western countries. PayPal has gained significant popularity due to the security and simplicity of its transactions and its wide acceptance among merchants.

Competition in logistics

JD Logistics

JD Logistics, owned by JD.com, is a significant competitor to Cainiao Network, Alibaba’s logistics arm. JD Logistics manages its own distribution centers and offers faster deliveries than Cainiao, making it the preferred choice for consumers who expect short delivery times. JD’s own infrastructure enables the company to efficiently manage its supply chain and effectively rival Cainiao.

SF Express

SF Express is one of China’s largest logistics service providers that operates independently of e-commerce platforms. It specializes in fast and reliable delivery within China and is gradually expanding to other markets, challenging

Compliance Assessment

Here is a comprehensive compliance assessment of Alibaba Group, examining whether the company operates in accordance with legal regulations. This evaluation focuses on Alibaba’s response to evolving regulations in key areas, particularly in the Chinese technology market, where regulatory demands are changing rapidly. In recent years, Alibaba has faced increasing scrutiny from the Chinese government regarding monopolistic practices, data protection, and the financial system.

Antitrust Law and Competitive Practices

Chinese Antitrust Law: In 2021, the Chinese government introduced numerous antitrust measures aimed at limiting the dominance of major tech firms, including Alibaba. The company was fined a record $2.8 billion for monopolistic practices, specifically for pressuring sellers to choose its platform exclusively, thereby limiting access to competing services. In response, Alibaba committed to adjusting its practices to comply with antitrust requirements, which is now a priority for the company.

Internal Education and Strategy Adjustment: Alibaba has implemented a series of training programs on antitrust regulations and competitive policies to avoid future violations. The shift in business strategy included ending the “choose one” practice and providing greater flexibility for sellers, who are now free to collaborate with competing platforms as well.

Data Protection and User Privacy

Personal Information Protection Law (PIPL): In August 2021, China implemented the Personal Information Protection Law (PIPL), akin to the EU’s GDPR, requiring companies to collect, store, and process data following strict privacy standards. Alibaba has adapted its procedures to PIPL, introducing internal privacy policies and transparency regarding data collection.

Transparency and User Control: In response to the new regulations, Alibaba launched awareness campaigns to inform users about what data is collected and give them more control over sharing personal information. Nevertheless, Alibaba’s compliance with PIPL is closely monitored by Chinese regulatory authorities.

Financial and Payment Services Regulations

Ant Group and Alipay: Ant Group, Alibaba’s subsidiary managing Alipay – China’s largest digital payment platform – came under intense scrutiny after its planned 2020 IPO was halted by Chinese regulators over concerns regarding financial risk and transparency in consumer loans and risk management.

We can learn more details from the extensive article described under this source: https://www.nytimes.com/2020/11/06/technology/china-ant-group-ipo.html

Compliance with Financial Sector Regulations: The Chinese government mandated a restructuring of Ant Group, requiring it to become a financial holding company and comply with financial regulations. The company has since implemented new compliance standards to ensure safety and transparency in financial operations and to mitigate risk for users.

Compliance in Cloud Computing and Data Processing

Cloud Computing Regulations: Alibaba Cloud’s operations, especially outside China, are subject to various regulations regarding data security and localization. Many countries require citizen data to be stored on local servers, which necessitates Alibaba Cloud to adapt its infrastructure accordingly.

Certifications and Security Standards: Alibaba Cloud has invested in obtaining security and compliance certifications such as ISO 27001 and SOC 2 to meet both domestic and international regulatory standards. The company also undertakes significant measures to ensure its cloud systems meet cybersecurity standards, addressing national data protection requirements.

Anti-Fraud and Platform Accountability

Seller Supervision and Product Quality: Alibaba has implemented rigorous regulations on the quality of products sold on its platforms to prevent the sale of counterfeit and non-compliant goods. As part of these efforts, the company monitors seller activity, imposes restrictions on fraudulent entities, and cooperates with authorities to enforce trade regulations.

Anti-Fraud Program and Consumer Rights Protection: In response to fraud cases, Alibaba has launched an anti-fraud program that includes transaction monitoring and strict seller verification policies. The company collaborates with regulatory authorities to ensure platform compliance with consumer protection standards.

Challenges and Future Steps

Despite Alibaba’s compliance efforts, the company faces significant challenges due to the increasing regulatory scrutiny, especially in China. Regulatory changes, particularly in digital finance and data protection, require Alibaba to continuously monitor and adjust policies to meet regulator expectations and avoid further penalties. Moving forward, Alibaba is expected to intensify compliance procedures and strengthen its relationships with regulators to ensure transparency and maintain trust among authorities and consumers.

Summary:

Alibaba Group undertakes a wide range of initiatives to comply with increasing regulatory requirements, both domestically and internationally. The company allocates substantial resources to developing compliance systems, adapting business practices to local regulations, especially in data protection and finance. Although Alibaba has been affected by high antitrust fines and the restructuring of Ant Group, it is actively working to align with new requirements and prevent further violations.

Alibaba’s ability to manage compliance and adapt to new regulations will be crucial to its future growth and maintaining trust among consumers and investors, especially in the Chinese market and in international expansion, where diverse legal requirements are becoming increasingly complex and restrictive.

Macroeconomic Analysis

Here is a macroeconomic analysis of Alibaba Group, assessing the impact of key external factors on the company’s operations. As a global tech player, Alibaba operates in a dynamically changing economic environment where aspects such as monetary policy, economic shifts in China, and global trade tensions significantly impact its strategies and financial performance.

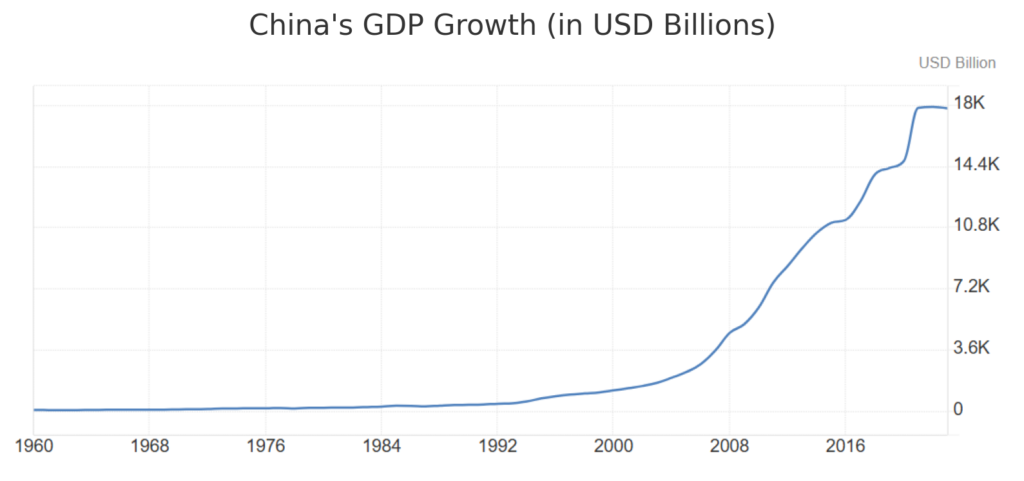

Economic Growth and the Condition of the Chinese Economy

China’s Economic Growth Rate: China has recorded steady economic growth for years, which has supported the development of companies like Alibaba. The expansion of the middle class and the digital technology sector in China has significantly increased demand for e-commerce, financial services, and cloud technologies, driving Alibaba’s rapid growth. However, recent economic challenges, such as the impact of the “zero-COVID” policy, may limit consumption growth, potentially impacting Alibaba’s revenue on the domestic market.

Government Economic Policy: The Chinese government promotes a consumer-driven economy, which benefits Alibaba as an e-commerce leader. However, government initiatives aimed at reducing financial risk and limiting reliance on the private sector, particularly in fintech and cloud services, could restrict Alibaba’s growth opportunities in areas like digital finance.

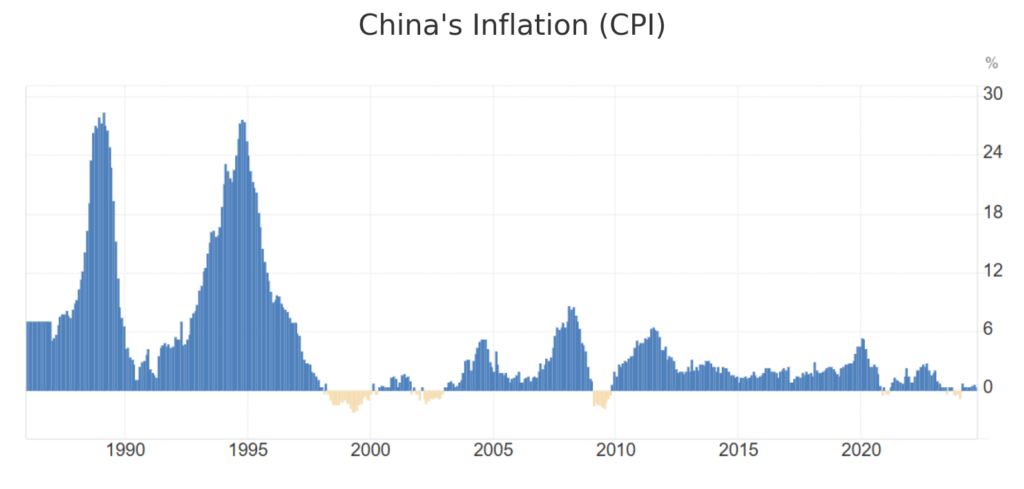

Inflation and Monetary Policy

Inflation: Rising inflation can affect Alibaba’s operating costs, particularly in logistics, wages, and material purchases. Higher transport and infrastructure maintenance costs (Cainiao Network) could reduce profit margins. Inflation also erodes consumer purchasing power, potentially impacting spending and thus sales on Alibaba’s e-commerce platforms.

China’s Monetary Policy: In times of economic slowdown, the Chinese government may lower interest rates and introduce monetary stimuli to support the economy. Such actions could benefit Alibaba by encouraging consumer spending and supporting financial services growth, such as consumer loans offered by Ant Group. However, any tightening of monetary policy and an increase in interest rates to control inflation could negatively affect consumer spending and limit Alibaba’s growth.

Exchange Rates and Currency Volatility

Exchange Rate Impact on International Operations: As Alibaba expands its international operations, currency volatility becomes an influential factor in its financial performance. A strengthening of the Chinese yuan against other currencies, such as the U.S. dollar, could reduce the price competitiveness of Alibaba’s products abroad. Conversely, a weaker yuan could increase the value of revenue generated outside China when converted to Chinese currency, but it would raise the cost of imports and foreign technology purchases.

Expansion in Markets with Unstable Currencies: Alibaba invests in emerging markets, such as Southeast Asia, where currency volatility is often higher. Exchange rate fluctuations can impact Alibaba’s revenue in these regions, exposing the company to currency risk, which requires financial hedging and protective strategies.

Global Trade Tensions and Protectionist Policies

U.S.-China Relations: Trade conflicts between the U.S. and China and government-imposed restrictions on technology and trade significantly affect Alibaba. The U.S. has introduced regulations limiting Chinese tech companies’ access to key technologies and components, which could hamper Alibaba’s innovation and cloud technology development. Trade tensions also influence the perception of Chinese brands in international markets, limiting expansion opportunities.

Protectionist Policies in Other Markets: Many countries are implementing policies to protect local markets from foreign giants, which also affects Alibaba. For example, India has imposed restrictions on Chinese apps and platforms, reducing Alibaba’s presence in that market. Other countries introduce local regulations requiring data storage within national borders and local infrastructure, which increases operating costs and complicates international operations.

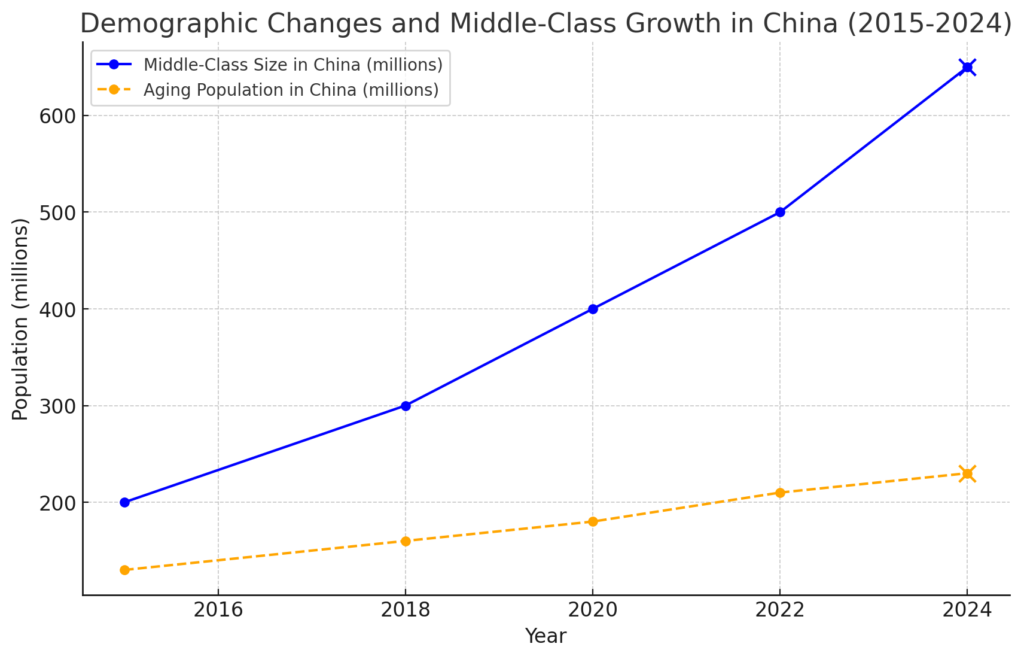

Demographic Changes and Middle-Class Growth

Middle-Class Growth in China: The growth of the middle class in China increases demand for products and services on Alibaba’s e-commerce platforms. The increasing number of consumers interested in premium and imported goods presents Alibaba with growth opportunities in high-quality product segments. Demographic shifts and the rising number of internet users, especially in smaller cities, also expand Alibaba’s market reach.

Aging Population and Changing Preferences: China’s aging population may affect consumption levels, posing a risk to Alibaba’s e-commerce. Older consumers may have different purchasing preferences, requiring adjustments in offerings and marketing strategies. At the same time, the need for more healthcare services and supportive technology for the elderly could create new opportunities in the health and innovation sectors.

Ongoing Digitalization and Technological Development

Global Digitalization Growth: The global drive for digitalization and e-commerce growth supports Alibaba’s activities in international markets. The increasing demand for cloud and e-commerce services in Southeast Asia, Latin America, and Africa presents Alibaba with further growth opportunities. Advanced solutions, such as artificial intelligence and big data, enable Alibaba to enhance customer service quality and personalize offerings.

Innovations in Digital Payments and Fintech: The trend towards cashless payments and fintech development worldwide supports the growth of Ant Group and Alipay, enhancing growth potential. The digitalization of the financial sector enables Alibaba to expand financial services, which could be crucial in emerging markets and countries with limited banking infrastructure.

Alibaba Group is heavily influenced by macroeconomic factors that can both support and limit its activities. The dynamics of economic growth in China, inflation, exchange rates, and global trade tensions affect the company’s profitability and development. Alibaba’s activities in e-commerce, digital finance, and cloud services depend largely on China’s monetary and economic policies, as well as the company’s ability to adapt to global regulatory and competitive requirements.

Rising digitalization and demographic shifts support Alibaba’s growth, particularly in consumer-driven segments such as e-commerce and cloud services. However, challenges related to trade tensions and inflation demand careful management and hedging strategies. Given the growing macroeconomic challenges, Alibaba must demonstrate flexibility and adaptability to maintain stable growth and leverage new opportunities in international markets.

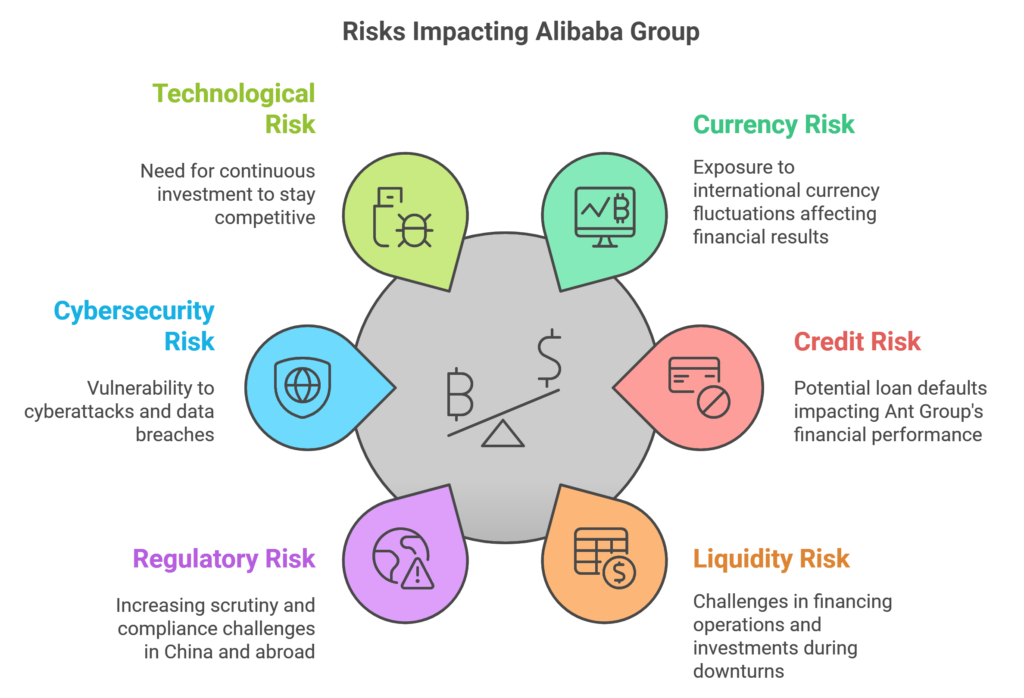

Risk Analysis

A risk analysis for Alibaba Group highlights key factors that may impact the company’s financial performance, operational activities, and regulatory compliance. As a global tech corporation, Alibaba faces challenges from international markets, trade tensions, and rapid changes in the Chinese regulatory landscape.

Financial Risks

Currency Risk: As Alibaba conducts a significant portion of its business internationally, it is exposed to currency fluctuations, particularly between the Chinese yuan and other currencies such as the U.S. dollar. Exchange rate volatility can affect the value of revenue and costs related to foreign technology purchases, adding uncertainty to financial results and potentially requiring costly currency hedges.

Credit Risk: Ant Group, Alibaba’s financial subsidiary, offers various financial products, including consumer loans and business credit. Amid economic slowdown and potential increases in consumer debt in China, there is a risk of rising loan defaults, which could impact Ant Group’s financial results and require additional reserves.

Liquidity Risk: Alibaba maintains a vast infrastructure and invests heavily in technology development, cloud computing, and international expansion. In the event of financial market downturns or limited access to capital, Alibaba could face challenges in financing ongoing operations and new investments, necessitating stable cash reserves.

Legal Risks

Regulatory Risk in China: Alibaba is impacted by increasing regulatory scrutiny from the Chinese government, particularly regarding antitrust laws, data protection, and the financial sector. In 2021, the company faced a record fine for monopolistic practices, highlighting heightened oversight of major tech firms in China. Regulatory risks could negatively affect Alibaba’s operations, particularly as financial and cloud service regulations evolve.

Compliance with International Data Protection Laws: Operating globally, Alibaba must comply with various data protection regulations, including Europe’s GDPR, California’s CCPA, and China’s PIPL. Non-compliance with local regulations could result in hefty fines and restricted access to certain markets, limiting the company’s expansion opportunities and impacting its reputation.

Risk Related to Sanctions and Trade Restrictions: Trade conflicts between the United States and China, as well as sanctions on Chinese tech companies, pose challenges for Alibaba. Restrictions on access to U.S. technology, components, and financial systems could weaken Alibaba’s competitiveness and limit its ability to develop cloud services and AI solutions.

Operational Risks

Data Protection and Cybersecurity Risk: As an operator of e-commerce platforms and a provider of cloud services, Alibaba is vulnerable to cyberattacks and data security breaches. In cases of data leaks or other security breaches, the company could face severe financial and reputational damage as well as regulatory penalties.

Technological Risk: Alibaba must continually invest in technology to keep up with competitors such as Amazon, JD.com, and Tencent, which requires substantial financial and technological resources. Failures in technological investment or deployment of new solutions could weaken the company’s competitive edge and result in user attrition in favor of other platforms.

Supply Chain and Logistics Risk: Alibaba’s operations rely on its extensive Cainiao Network logistics network, which enables quick deliveries within China and abroad. In cases of supply chain disruptions (e.g., due to international crises, pandemics, or resource shortages), Alibaba may encounter delays in deliveries and customer dissatisfaction, potentially impacting user loyalty and market standing.

Reputational Risk: As one of China’s largest tech companies, Alibaba is constantly under scrutiny from markets and regulators. Any regulatory violations, instances of fraud on the platform, or data privacy controversies could harm the company’s reputation, reduce investor and user trust, and lead to a decline in market value.

Alibaba Group faces multiple financial, legal, and operational risks that impact its operations and financial outcomes. Financial risks such as currency volatility and increasing credit risk may influence the company’s profitability, especially in the context of international expansion and Ant Group’s operations. Legal risks arising from regulatory changes in China and international data protection laws present significant challenges, requiring Alibaba to adapt its operations to increasingly strict standards and regulatory demands. Operational risks, including cybersecurity threats, technological competition, and complex logistics infrastructure, may affect the company’s ability to maintain a competitive edge and meet customer satisfaction. To minimize the negative effects of these risks, Alibaba must implement effective risk management strategies, such as regulatory compliance monitoring, investment in technology security, and financial hedging, to maintain stability amid growing macroeconomic and regulatory challenges.

Public Information

Collecting information from publicly available sources is essential for verifying data about Alibaba Group and other corporations. This process enables a better understanding of the company’s operations, financial performance, strategic shifts, regulatory compliance, and risks. Here’s an overview of available sources from which one can gather information about Alibaba:

Financial and Stock Market Reports

Annual Financial Reports: Alibaba Group publishes its annual reports, accessible on the official company website in the investor relations section and on stock exchanges where it is listed (e.g., NYSE, Hong Kong Stock Exchange). These reports contain detailed information on financial results, revenue structure, investment strategies, and risks.

Quarterly Earnings Reports: Alibaba regularly publishes quarterly earnings, providing insight into short-term financial changes and how the company is addressing market and regulatory challenges.

Business Databases and Registers

SEC EDGAR (Electronic Data Gathering, Analysis, and Retrieval): The U.S. Securities and Exchange Commission (SEC) requires companies listed in the United States to publish essential documents, such as financial reports, IPO filings, and risk disclosures, which are available in the EDGAR system.

Hong Kong Stock Exchange Database: As Alibaba is also listed in Hong Kong, it provides documents required by the exchange, including financial reports, shareholder meeting protocols, and notices of significant operational and financial changes.

China National Enterprise Credit Information Publicity System: This official Chinese registry collects data on Chinese enterprises, including Alibaba Group, licensing information, regulatory compliance, and the legal status of representatives.

Industry Analyses and External Consulting Reports

Consulting and Market Analysis Reports: Consulting firms such as McKinsey, Deloitte, PwC, EY, and other analytical organizations publish reports on the technology, e-commerce, and financial services sectors in China and globally. These reports often include market trends, competitive strategies, and risk assessments that cover companies like Alibaba Group.

Credit Ratings and Reports: Rating agencies like Moody’s, Standard & Poor’s, and Fitch assess the creditworthiness and financial stability of large corporations, including Alibaba. These reports help in evaluating the investment risks associated with the company.

Analyst Opinions and Market Reports

Stock Analyst Reports: Analysts from major investment banks, such as Goldman Sachs, JPMorgan, and Morgan Stanley, publish reports on Alibaba, often including financial forecasts, macroeconomic analysis, and evaluations of the company’s business strategy.

Commentary and Assessments on Social Media: Analyst opinions and other expert evaluations are also available on platforms like Twitter, LinkedIn, and YouTube. Market experts share analyses of Alibaba’s financial results, industry prospects, and emerging market trends.

Regulatory Bodies and Oversight Institutions

Chinese State Administration for Market Regulation (SAMR): SAMR issues announcements on antitrust measures, fines, and other regulatory actions affecting Alibaba, which is crucial in assessing the operational compliance of the company with Chinese law.

Local and International Data Protection Authorities: Any decisions and communications regarding compliance with data protection regulations (such as Europe’s GDPR or China’s PIPL) are issued by relevant supervisory authorities, such as the European Data Protection Board (EDPB) and its Chinese counterparts.

Publicly available sources enable a thorough analysis of Alibaba Group’s operations. Information available in financial reports, industry analyses, media publications, and regulatory announcements allows investors, analysts, and regulators to assess the company’s financial performance, compliance with regulations, and investment risk. Regular monitoring of these sources provides an up-to-date view of the company’s condition, as well as its ability to meet market and regulatory challenges.

Undermining financial compliance

A financial statement analysis of Alibaba Group for potential accounting manipulation requires a thorough examination of the company’s key financial indicators and accounting practices. Below is a detailed look at crucial areas that may suggest potential irregularities or demonstrate financial stability and compliance.

Revenue Recognition

Revenue Recognition Practices: Alibaba adheres to international accounting standards (IFRS), which enhances the transparency of its financial statements. Recent reports indicate stable revenue growth, with a 6.6% increase in revenue to 221.87 billion YUAN in the fourth quarter of the fiscal year. This steady growth suggests accurate revenue recognition practices without prematurely recognizing revenues, a common accounting manipulation tactic.

Days Sales Outstanding (DSO): The DSO metric indicates the average time it takes to collect payments from sales. Alibaba’s stable DSO suggests effective receivables management and avoids artificially inflating revenue by extending payment terms. A lack of significant DSO fluctuations indicates the company likely does not recognize revenue before receiving payment.

Operating Costs and Profit Margins

Operating Cost Fluctuations: Alibaba invests heavily in technology development, international expansion, and logistics infrastructure. Rising operating costs are primarily associated with these strategic investments, which align with the company’s growth plans. The absence of sudden drops in operating costs suggests the company is not deferring expenses to improve short-term financial performance artificially.

Gross vs. Net Profit Margins: Consistency between gross and net margins for Alibaba suggests effective cost management. If the company regularly reports stable margins, it indicates that expenses are being accurately recorded per accounting standards without shifting costs to other categories.

Liabilities and Debt

Financial Support from Subsidiaries: Alibaba collaborates with several subsidiaries, including Ant Group, which focuses on financial services. Relationships between these entities are reported transparently, indicating financial transparency in internal operations. There is no evidence of hidden intercompany loans or guarantees, which would reduce the likelihood of debt concealment.

Debt Ratio: Alibaba maintains a moderate debt level relative to assets, which indicates financial stability. The company does not show signs of excessive debt or practices to obscure liabilities, which are common indicators of potential accounting manipulation. A stable debt ratio further reinforces the company’s financial credibility.

Provisions and Contingent Liabilities

Credit Loss Provisions in Ant Group: As a financial subsidiary, Ant Group faces risks related to consumer and business loans. Alibaba reports appropriate credit loss provisions, consistent with international accounting standards. Adequate provisioning minimizes the risk of sudden losses and reflects prudent risk management.

Contingent Liabilities: Alibaba transparently reports potential risks, including those associated with antitrust regulations and other legal obligations. For example, the company paid a record antitrust fine in 2021, demonstrating adherence to Chinese regulatory requirements and mitigating legal risk.

Amortization and Intangible Assets

Amortization of Intangible Assets: As a tech company, Alibaba holds significant intangible assets, including technologies, patents, and brands. A conservative approach to amortization indicates careful asset management without attempts to inflate asset values for improved financial results. The absence of substantial increases in intangible asset valuations confirms compliance with market practices.

Cash Flows and Earnings Quality

Operating Cash Flow: The analysis shows that cash flows align with net income, suggesting high earnings quality and a lack of accounting manipulation. Stable cash flows are a crucial indicator that Alibaba’s financial results are not inflated through premature revenue recognition or delayed payments.

https://www.macrotrends.net/stocks/charts/BABA/alibaba/cash-flow-statement?freq=A

Free Cash Flow (FCF): A stable FCF level indicates that Alibaba generates healthy cash flow, demonstrating effective management of its operating activities. High net income paired with low FCF could indicate manipulation; however, for Alibaba, these metrics are consistent, which speaks to strong financial management.

https://ycharts.com/companies/BABA/free_cash_flow

Related Party Transactions

Transfer Pricing and Related Party Transactions: Alibaba transparently reports transactions with subsidiaries, including Ant Group. No ambiguities in transfer pricing practices suggest adherence to international accounting standards and minimize the risk of profit shifting to subsidiaries.

Segment Reporting: Alibaba provides detailed data on the performance of various segments, such as e-commerce, cloud computing, and finance. Transparent segment reporting enables a clear understanding of where the company generates its revenue, increasing financial transparency and limiting the potential to obscure weaker performance in certain divisions.

The analysis of Alibaba Group’s financial statements does not reveal significant evidence of accounting manipulation. The company reports its results in compliance with international accounting standards, and its financial practices appear transparent and consistent with regulatory requirements. Stable cash flow results, consistency between revenue and expenses, and appropriate credit loss provisions suggest reliability and professionalism in Alibaba’s financial management.

While no evidence of manipulation was found, it is advisable to continue monitoring the company’s operations, particularly in light of China’s evolving regulatory landscape and global market challenges. Changes in Chinese law could impact Alibaba’s reporting methods and earnings generation, so regular review is recommended to ensure full regulatory compliance and operational transparency.

Field Investigations

Here’s a field investigation into Alibaba Ltd., featuring interviews with former employees and an analysis of the company’s operations. This exploration highlights key aspects of Alibaba’s workplace culture, employee experiences, and operational practices:

Interviews with Former Employees:

Work Culture

“996” Work System: Alibaba, like many major Chinese tech companies, adheres to a “996” work culture, which means working from 9:00 AM to 9:00 PM, six days a week. This practice, while common in China’s tech industry, is controversial due to concerns about employee well-being and work-life balance. Jack Ma, Alibaba’s founder, famously described this work ethic as a “blessing” for young people who are ambitious and eager to advance quickly in their careers. However, some former employees report that this exhausting schedule often leads to burnout, especially among those juggling high-intensity tasks.

Dynamic Growth Opportunities: Many former employees acknowledge that Alibaba offers robust career growth and hands-on learning, especially for young professionals. The company encourages internal competition, which can lead to fast promotions for high performers. However, this intense atmosphere has a downside: high expectations for quick results and constant pressure to excel. Former employees describe the work culture as both exciting and stressful, with long hours and high stakes as the norm.

Supervisor Relationships: The company employs a structured hierarchical management style, combined with performance-based rewards, which adds pressure to meet high standards. Some former employees describe the atmosphere as highly competitive, while others note the encouragement for innovation and self-motivation. However, internal competition can lead to interpersonal tension, and some former employees express concerns about high stress levels.

Employee Conditions and Compensation

Performance-Based Evaluations: Employees at Alibaba are evaluated through a performance-based system that directly affects their compensation and career progress. This emphasis on results has led some workers to extend their work hours to meet targets. While some employees appreciate the growth opportunities, others feel that the workload is overwhelming and compromises their work-life balance.

Burnout Risks: Many employees report challenges with balancing the company’s intense demands with personal life, leading to high burnout rates. Frequent turnover has been noted, with some employees citing difficulties in maintaining personal commitments alongside Alibaba’s rigorous demands as a reason for departure.

Company Operations Analysis in Practice:

Technology and Innovation

Leading-Edge Technology: Alibaba invests heavily in artificial intelligence, big data, and facial recognition technology, making it a leader in technological implementation. Facial recognition systems are even used to streamline employee check-ins. While these innovations are seen as forward-thinking, they also raise questions about data privacy and surveillance.

AI-Powered Operations: Alibaba uses artificial intelligence to enhance sales processes, personalize customer experiences on platforms such as Tmall and Taobao, and improve logistics efficiency. The company’s automated logistics systems, including drone deliveries, are designed to improve efficiency, reduce costs, and set new standards in operational excellence.

Human Resource Management

Efficiency Over Employee Well-Being: Interviews suggest that Alibaba prioritizes operational efficiency, which sometimes comes at the expense of employee well-being. In 2021, an incident where Alibaba dismissed an employee who reported sexual harassment sparked public scrutiny of the company’s handling of workplace issues. This incident highlighted potential gaps in Alibaba’s crisis management and employee support policies. I invite you to read the article: https://www.aljazeera.com/economy/2021/8/9/rocked-by-sexual-assault-complaint-chinas-alibaba-fires-manager

Diversity and Inclusion Policies: Although Alibaba promotes diversity and inclusion on paper, former employees have reported internal challenges, such as issues with equal treatment and workplace transparency. While the company has taken some steps to improve its diversity initiatives, former employees describe the culture as highly demanding and competitive.

Alibaba Group remains a global leader in technology and innovation, applying advanced systems to boost efficiency and improve the customer experience. By embracing AI and automation, Alibaba sets high standards for operational excellence and technological advancement.

However, the company’s intense work culture, based on the “996” model, and high expectations have sparked concerns. Employee turnover and burnout rates are notably high, suggesting that Alibaba’s human resource practices may need reassessment to foster a healthier work-life balance. Public scrutiny around incidents like the sexual harassment case also indicates areas for improvement in employee support and organizational transparency.

Ownership Structure Analysis

Major Shareholders in 2024

Here is a detailed analysis of Alibaba Group’s ownership structure and financial mechanisms, including the methods the company uses to comply with Chinese regulations while allowing foreign investors to participate in its business.

Alibaba Group’s Ownership Structure

Institutional Investors: Alibaba Group has attracted significant interest from institutional investors, though their stake is relatively small (around 1.78%). Major institutional shareholders include global investment funds such as BlackRock and Vanguard Group, as well as other international asset management firms.

Individual Investors: Alibaba is unique among large tech companies, as about 98.22% of its shares are held by individual investors. This means the majority of shareholders are retail investors who bought shares directly on the stock exchange. This structure can lead to greater price volatility, as individual investors often react more emotionally to market events.

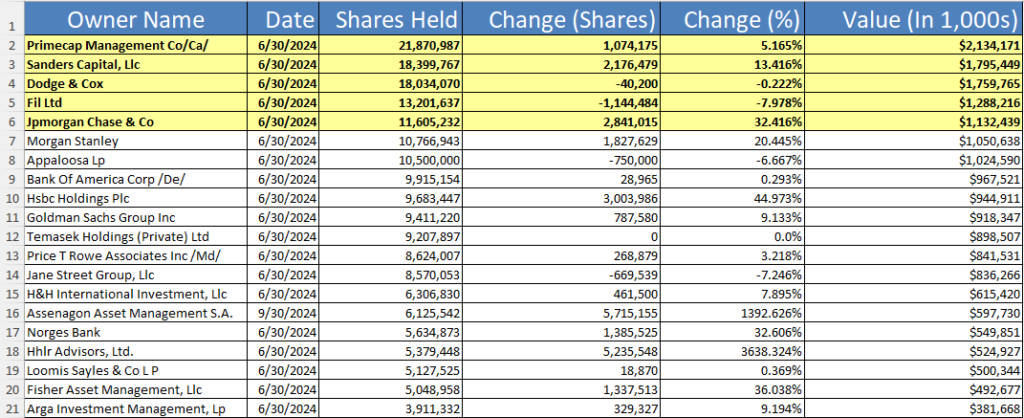

Here are the largest individual investors in Alibaba Group Holding Limited (as of June 30, 2024):

Jack Ma: Alibaba’s co-founder and former chairman, Jack Ma, holds about 4.8% of the company’s shares, equivalent to 1,043,831,112 shares.

Joseph Tsai: Co-founder and vice chairman of the board, Joseph Tsai, holds about 1.4% of the company’s shares, equivalent to 309 million shares.

Daniel Zhang: Former Alibaba CEO Daniel Zhang held a stake in the company, but the exact number of shares is not publicly available.

Lucy Peng: Co-founder and former human resources director Lucy Peng also held shares in the company, but details are not publicly available.

It should be noted that the exact shareholding information of individual investors may change over time and is not always publicly available.

Lack of Insider Ownership: Unlike many American tech giants, Alibaba has minimal insider ownership (key management figures) or does not publicly report such ownership. In some tech companies, founders and key executives hold significant shares, giving them greater influence over decision-making. In Alibaba’s case, the absence of such a structure may allow for greater flexibility in business decisions, but it also leaves open the potential for more frequent management changes.

Variable Interest Entity (VIE) Structure

Due to Chinese laws that restrict foreign investments in the tech sector, Alibaba employs a Variable Interest Entity (VIE) structure to allow foreign investors to participate in the company without directly owning its assets in China.

How the VIE Structure Works

Entities in China and Overseas: The VIE structure requires the creation of two main entities:

- An offshore entity registered outside China that receives investments from international investors.

- A local Chinese entity (such as Alibaba Technology in China), which formally owns and controls the assets and conducts operations within China.

Control Agreements: The offshore entity signs control agreements with the local entity, granting the offshore entity rights to the local entity’s profits and influence over its management decisions. These agreements give foreign investors exposure to Alibaba’s business operations without direct share ownership in the Chinese entity.

Risks Associated with the VIE Structure: The VIE structure is vulnerable to regulatory risks. Chinese authorities could change the law, potentially invalidating the control agreements and limiting foreign investors’ rights. This risk is particularly relevant given recent moves by the Chinese government to exert more control over the tech sector.

Suspected Capital Transactions and Regulatory Concerns

To date, there have been no publicly documented suspicious capital transactions related to Alibaba Group. However, due to the increasing scrutiny from Chinese regulators, the company must adhere strictly to local laws and international accounting standards. Here are some regulatory actions that have impacted Alibaba’s operations:

- 2021 Antitrust Fine: Following an antitrust investigation, Chinese authorities fined Alibaba $2.8 billion for monopolistic practices. While this penalty was not linked to suspicious capital transactions, it reflects stricter regulation of Chinese tech giants, which could impact cash flows and investments.

- Tighter Control Over the Fintech Sector: Chinese authorities have increased regulation of the financial sector, affecting Alibaba’s subsidiary, Ant Group, whose IPO was halted in 2020. As the fintech arm of Alibaba, Ant Group now faces stricter regulatory requirements, impacting the valuation and financial potential of the broader Alibaba Group.

Alibaba Group has a diverse ownership structure with a majority stake held by individual investors and minimal insider ownership. The VIE structure enables the company to attract foreign capital despite Chinese restrictions in the tech sector. Although there is no evidence of suspicious capital transactions, the company faces mounting regulatory pressure from the Chinese government, requiring high transparency in its reporting practices.

Risks associated with potential changes in Chinese law and VIE regulations may impact Alibaba’s position in the future, and investors should be aware of the potential challenges associated with this structure.

Ownership

High Selling Activity in 2021

In Q3 and Q4 of 2021, we observe significant selling activity among institutions, along with high, though comparatively lower, purchasing levels. The increase in sales might have resulted from concerns over stricter regulations imposed by the Chinese government on major tech companies, which impacted Alibaba’s valuation and led some institutions to reduce their exposure to mitigate risks. This situation posed a challenge for investors who needed to assess regulatory risks and Alibaba’s future in this environment.

Stabilization and Recovery in 2022

In 2022, institutional selling activity began to decrease, potentially indicating a more stable regulatory environment and growing confidence in Alibaba. A gradual increase in inflows suggests that some institutions see long-term potential in Alibaba, especially if the regulatory situation in China remains stable. Individual investors might interpret this as a sign that Alibaba is once again attracting institutional capital, which could positively affect its share price.

Renewed Interest in 2023 and 2024

In 2023, inflows started to increase, surpassing outflows in most quarters, indicating renewed interest from institutions. This is a key signal that institutions are finding value in Alibaba shares, despite past regulatory difficulties. This trend could stem from Alibaba’s strategic initiatives, such as investments in new technologies, international growth, and improved communication with the market and investors.

The rise in inflows alongside reduced selling activity in 2023 and 2024 suggests that institutions are beginning to play a larger role in Alibaba’s ownership structure, potentially leading to increased share price stability. For individual investors, this is a positive signal, as institutional capital usually stabilizes stock prices.

Current Institutional Ownership Percentage (13.47%)

This metric indicates that institutions currently hold 13.47% of Alibaba’s shares. This is a relatively moderate level compared to other global tech giants like Amazon or Apple, where institutions have a larger stake. For individual investors, this suggests that Alibaba’s stock may be more volatile, as institutional ownership generally stabilizes share prices. However, a lower institutional ownership can indicate higher growth potential, as more institutional involvement in the future could drive the stock’s valuation upward.

Number of Institutional Buyers (630) and Sellers (470)

The difference between the number of institutional buyers (630) and sellers (470) suggests a higher interest in buying. This indicates a positive sentiment toward the company in the past 12 months, with more institutions choosing to buy rather than sell. This can be a positive signal for investors, reflecting a growing confidence in Alibaba’s stability and growth potential.

Total Institutional Inflows ($5.41B) and Outflows ($2.89B)

The total value of institutional purchases (inflows) outweighs sales (outflows), meaning more capital is flowing into Alibaba than leaving it. This is a positive indicator, suggesting that institutions expect Alibaba’s stock value to rise. High inflows may reflect optimism around Alibaba’s future growth, possibly due to new projects, international expansion strategies, or an improved reputation after regulatory challenges.

Analyst Forecasts

Consensus Rating (Moderate Buy)

The “Moderate Buy” rating is based on evaluations from 15 Wall Street analysts who reviewed Alibaba over the last 12 months. Out of these analysts:

- 13 have given a “Buy” rating,

- 2 have given a “Hold” rating,

- 0 have recommended “Sell.”

This consensus rating suggests that analysts generally have a positive view of Alibaba’s potential, but the “Moderate Buy” label indicates some caution. While most analysts recommend buying, the two “Hold” ratings suggest a degree of uncertainty or potential risks that could affect Alibaba’s short-term performance.

Consensus Price Target ($113.13) and Potential Upside (20.11%)

The average 12-month price target for Alibaba is $113.13, representing an anticipated 20.11% upside from its current price of $94.18. This target is based on analysts’ projections for Alibaba’s stock performance over the next year.

- High Price Target ($145.00): The highest forecasted price target for Alibaba is $145.00, which implies a more optimistic outlook from certain analysts. If Alibaba reaches this target, it would represent a significant increase from its current price, suggesting that some analysts believe Alibaba has the potential for considerable growth if favorable conditions materialize.

- Low Price Target ($85.00): The lowest price target is $85.00, reflecting a more conservative view. This lower target likely factors in potential risks, such as regulatory challenges in China, competitive pressures, or global economic concerns, which could impact Alibaba’s performance.

The spread between the high and low price targets indicates a moderate level of uncertainty among analysts about Alibaba’s future. A wide spread can imply differing opinions on the stock’s risks and opportunities, while a narrow spread would indicate stronger consensus.

Historical Price Movement and Projection

The accompanying line chart shows Alibaba’s stock price movements over the past year and projects potential growth based on the average price target. Recent stock performance trends reveal periods of volatility, reflecting the challenges Alibaba has faced, including regulatory scrutiny and macroeconomic factors.

The upward trend in the projected price range indicates a general belief among analysts that Alibaba’s stock may increase over the next 12 months, though the spread of potential outcomes underscores that the path may not be linear.

Implications for Investors

Positive Growth Potential

The “Moderate Buy” rating and 20.11% potential upside suggest that Alibaba is seen as an attractive investment with the possibility of strong returns over the next year. For investors looking for growth stocks, this indicates that Alibaba could offer significant returns, assuming the company meets or exceeds performance expectations.

Risk vs. Reward

While the overall sentiment is positive, the spread between the high and low price targets indicates some level of risk. Investors should be aware that, while Alibaba has growth potential, there are factors that could negatively impact its stock price, leading to the lower forecasted target of $85. The two “Hold” ratings suggest that some analysts are cautious, potentially due to regulatory risks, economic pressures, or uncertainties in the Chinese market.

Investment Horizon

Given the projected 12-month timeline for these targets, Alibaba may be more suitable for medium- to long-term investors who can hold the stock through potential short-term volatility. The price forecast suggests that short-term gains may be less certain, and investors should be prepared for possible fluctuations.

Consideration of Market Conditions

For Alibaba to reach the upper end of the price targets, it will likely need a favorable regulatory environment in China, steady economic conditions, and strong performance across its business segments, including e-commerce, cloud computing, and digital media. Investors should monitor these factors, as they will heavily influence Alibaba’s ability to achieve these targets.

Alternative Scenario – Potential Downside

The lower price target of $85 serves as a cautionary benchmark. If Alibaba encounters unfavorable developments, such as intensified regulations or economic slowdowns, investors could face losses. This makes it essential for investors to consider their risk tolerance and the possibility of stock price declines.

Overall, the consensus from analysts is moderately optimistic about Alibaba’s growth potential. For investors, the moderate buy rating and 20% upside potential indicate that Alibaba could be a strong addition to a growth-oriented portfolio, but with an understanding of the risks involved. It may be a worthwhile investment for those who believe in Alibaba’s long-term growth story and are willing to navigate some short-term uncertainty.

Compliance Verification:

Here is a compliance verification analysis for Alibaba, focusing on regulatory adherence and potential links with suspicious entities. This assessment is crucial for understanding Alibaba’s operational stability and the potential risks associated with its business practices.

Regulatory Compliance

Antitrust Regulations: In China, Alibaba, like other major tech companies, has faced increasing antitrust scrutiny. In 2021, the company was fined $2.8 billion for monopolistic practices. Compliance analysis should include an assessment of Alibaba’s efforts to adapt to these new regulations, such as avoiding practices that exclude competition and promoting transparency in its business relationships.

Data Privacy and Protection: China has implemented strict data privacy regulations, such as the Personal Information Protection Law (PIPL). Compliance in this area requires Alibaba to adhere to stringent data processing requirements for user information, both in China and in other countries with similar regulations, like the GDPR in the European Union.

Financial Regulations: As a company listed on the New York Stock Exchange and the Hong Kong Stock Exchange, Alibaba must comply with the financial reporting standards of both markets. Compliance in this area involves adhering to US Generally Accepted Accounting Principles (GAAP) and meeting the regulatory requirements of Chinese financial market authorities.

Connections with Suspicious Entities

Transparency in Ownership Structure: Due to Alibaba’s complex ownership structure and the use of a Variable Interest Entity (VIE) mechanism, which allows it to attract foreign capital, it is essential to monitor any potential links with entities that raise concerns. The VIE structure is prone to manipulation and increases the risk of opaque financial relationships.

Political Connections: As a major player in China’s tech market, Alibaba may be scrutinized for potential ties to the Chinese government. In recent years, Chinese authorities have sought greater control over large tech companies, making it essential for Alibaba to operate transparently and avoid involvement in questionable activities or connections that could compromise its operational independence.

Analysis of Business Partners and Contractors: Alibaba collaborates with numerous suppliers and partners worldwide. Conducting regular due diligence on contractors is essential to avoid associations with companies involved in criminal activities, human rights violations, or other non-compliant actions on an international level.

Significance for Investors and Compliance Risks

Reputational Compliance Risk: Non-compliance with regulations can result in not only financial penalties but also significant reputational damage, which could affect stock value and investor trust.

Potential for International Sanctions: Given Chinese regulations and growing scrutiny from Western markets, Alibaba must avoid ties with entities subject to sanctions or operating in high-risk zones. Non-compliance with international regulations could limit its ability to operate in global markets.

Risk to Global Operations: Ensuring compliance with a wide range of international regulations is challenging for Alibaba, and potential regulatory changes could impact its business model, particularly in areas like fintech and e-commerce.

Speculative Information

Here is a speculative analysis of Alibaba, which may help investors gain insight into potential risks and opportunities. This information is advanced and should be approached with caution, as it is based on strategic speculation and may be difficult to verify.

Possible Breakup of Alibaba by the Chinese Government

There is speculation that the Chinese government may push for Alibaba to be broken up into smaller entities to reduce its market dominance and address monopoly concerns. This would aim to increase competition in the Chinese tech sector and limit Alibaba’s influence. If this scenario unfolds, shareholders might see a decline in stock value due to reduced stability of smaller entities. On the other hand, if the breakup results in more focused, specialized companies, they might attract investors who prefer more targeted investments.

Impact of Western Sanctions and Economic Decoupling

Given the escalating tensions between China and Western countries, especially the U.S., there is a risk that Alibaba could be subject to sanctions or export restrictions. If economic “decoupling” accelerates, Alibaba may struggle to access U.S. technology and capital. This could limit its international growth and ability to compete globally, potentially leading to a significant decrease in stock value and reduced interest from foreign investors.

Increased Chinese Government Control over Alibaba’s Operations

There has been speculation that the Chinese government may seek greater control over Alibaba, particularly given regulatory challenges and concerns about monopolistic behavior. This could involve placing government representatives on Alibaba’s board or influencing key operational decisions. Such developments could affect the company’s autonomy and decision-making, introducing political risks that some investors may find concerning.

Advanced Investments in Artificial Intelligence and Big Data

Alibaba is speculated to be increasing its investments in artificial intelligence (AI) and Big Data to compete with global tech giants. Potential acquisitions or partnerships with tech companies could accelerate these efforts, especially in areas like e-commerce, logistics, and advertising. If these speculations are accurate, Alibaba could gain a significant competitive edge, boosting its valuation. However, investments in AI and Big Data are costly and risky, which could impact its short-term profitability.

Reducing Dependence on the Chinese Market and Relocating Operations

Due to rising uncertainties around China’s economic policies and regulations, Alibaba may attempt to lessen its reliance on the domestic market. There is speculation that the company might relocate part of its operations abroad or focus on high-growth markets such as India, Africa, and Southeast Asia. This move could reduce regulatory risk, but would involve high relocation costs and the risk of failure in new markets.

Data Privacy Concerns and User Surveillance

As one of China’s largest companies, Alibaba is suspected of collaborating with the Chinese government on user monitoring, which may pose challenges in international markets. There are speculations that heightened control over user data could provoke regulatory responses from foreign governments. Countries like the U.S. and the EU are increasing pressure on data privacy, and Alibaba’s connections to the Chinese government could lead to restrictions on its operations outside China.

Interest in Cryptocurrency and Fintech Growth

After the failed IPO of Ant Group, Alibaba might explore new avenues in the fintech sector, especially in blockchain and cryptocurrencies. There is speculation that the company could develop innovative financial services, potentially involving cryptocurrency or asset tokenization. However, in China, where the government exercises strict control over financial markets, such initiatives may face regulatory limitations, adding speculative risk to Alibaba’s fintech ventures.

Further Regulatory Crackdown on Tech Companies in China

There are concerns that the Chinese government may continue to tighten its policies on large tech companies, particularly those listed abroad, like Alibaba. Speculation suggests that Alibaba might be forced to alter its business model or limit its global operations. These regulatory changes could significantly impact the company’s valuation and deter investors from buying Alibaba’s shares.

Forensic Report

Alibaba Group, one of the largest tech conglomerates in China, is a dominant player in e-commerce, cloud computing, and digital finance. Despite its success and global reputation, Alibaba has faced scrutiny regarding its business practices, regulatory compliance, and transparency. This report outlines potential criminalistic concerns related to Alibaba, focusing on accounting irregularities, management risks, undisclosed transactions, unethical business practices, and regulatory challenges.

Accounting Irregularities

Alibaba’s rapid growth and complex business structure, including a Variable Interest Entity (VIE) model, raise concerns about the transparency and accuracy of its financial statements. VIE structures allow Chinese companies to receive foreign investment while bypassing restrictions on foreign ownership in specific sectors. However, they also introduce complexity and risk regarding financial reporting.

Observed Issues:

- Revenue Recognition: There have been questions about Alibaba’s revenue recognition practices, specifically in its marketplace services. For instance, inflating revenue by prematurely recognizing sales or recording promotional incentives as actual revenue could artificially boost financial results.

- Overstated Assets: Alibaba’s investment in numerous subsidiaries and affiliates can make it challenging to assess the value of its assets accurately. Inaccurate valuations of intangible assets, such as goodwill from acquisitions, could inflate the company’s balance sheet.

- Debt and Liabilities Disclosure: Some analysts suggest that Alibaba may underreport its liabilities or leverage complex structures to keep certain debts off the books, creating an inaccurate picture of its financial health.

If Alibaba’s financial reporting does not accurately reflect its true financial position, it could mislead investors, inflate stock prices, and increase risks for stakeholders. These accounting irregularities could also lead to regulatory investigations and fines, damaging Alibaba’s reputation.

Bad Actors in Management or Key Roles

Alibaba’s top executives and key decision-makers play a significant role in shaping the company’s direction. There have been instances of conflicts of interest and questionable leadership decisions that could impact the company’s integrity and operations.

Observed Issues:

- Key Supplier Risks: Alibaba relies on various suppliers for its e-commerce, logistics, and cloud computing operations. Any unethical or illegal actions by these suppliers, such as using forced labor or unethical sourcing, could harm Alibaba’s reputation and expose it to regulatory penalties.

- Jack Ma’s Influence: Although no longer directly involved in daily management, Jack Ma’s substantial influence over the company’s culture and direction remains. His outspoken criticisms of regulatory authorities in 2020 led to increased scrutiny and tensions with the government, contributing to a crackdown on Alibaba and other tech firms.

- Conflict of Interest: Allegations exist that certain executives and senior managers may have personal interests in companies that collaborate with or supply services to Alibaba. Such relationships could create conflicts of interest, leading to decisions that benefit individuals rather than the company or shareholders.

Having individuals in key roles who act in their own interest rather than the company’s could lead to poor business decisions, regulatory issues, and loss of investor confidence. Furthermore, reliance on questionable suppliers could expose Alibaba to supply chain risks and reputational damage.

Undisclosed Transactions with Related Parties

Alibaba’s complex structure includes many subsidiaries, affiliates, and strategic partnerships. Transactions between Alibaba and its related entities could pose risks if they are not transparently disclosed, potentially leading to conflicts of interest and unfair financial practices.

Observed Issues:

- Subsidiary Transactions: Alibaba’s ownership structure includes multiple entities, including Ant Group and Cainiao Logistics. Transactions between Alibaba and its subsidiaries may not always be fully disclosed, creating potential conflicts and limiting transparency in financial reporting.

- Related Party Loans: Allegations have surfaced suggesting that Alibaba could be lending funds to entities with ties to its executives or board members. Such transactions, if not properly disclosed, could mislead investors about Alibaba’s cash flow and financial stability.

- Undisclosed Benefits to Key Individuals: Some reports suggest that Alibaba has provided financial benefits or incentives to individuals with close ties to the company or its subsidiaries, which may not be adequately disclosed.

Undisclosed transactions with related parties may lead to skewed financial results, investor mistrust, and possible regulatory actions. Transparency in these transactions is crucial for maintaining investor confidence and ensuring accurate financial reporting.

Illegal/Unethical Business Practices or Financial Reporting

Alibaba has faced multiple accusations of unethical practices, especially in its e-commerce platform operations. These accusations include counterfeiting issues, unfair competition, and potentially fraudulent reporting practices.

Observed Issues:

- Counterfeit Goods on Platform: Alibaba has been criticized for enabling the sale of counterfeit goods on its platforms. Despite efforts to combat counterfeiting, the problem persists, raising questions about Alibaba’s commitment to ethical e-commerce practices.

- Antitrust Violations: In 2021, Alibaba was fined $2.8 billion by Chinese regulators for monopolistic practices. Authorities accused Alibaba of forcing merchants to exclusively sell on its platforms, which restricted competition and may have violated fair trade practices.

- Inflated User Metrics: Some reports suggest Alibaba might be overstating its active user numbers, which are a key metric for evaluating the platform’s reach and market position. Overstating user metrics could mislead investors about Alibaba’s market influence and potential for growth.

Engaging in unethical business practices damages Alibaba’s brand image and can lead to severe legal consequences, as seen with the antitrust fine. Inflated metrics or inadequate control over counterfeit products can erode investor confidence and lead to increased regulatory scrutiny.

Undisclosed Regulatory, Product, or Financial Issues

As a major tech company operating in a highly regulated market, Alibaba faces various regulatory challenges. The company’s lack of transparency regarding regulatory, product, or financial risks could expose investors to unforeseen issues.

Observed Issues:

- Ongoing Regulatory Scrutiny: After the 2021 antitrust fine, Alibaba remains under significant regulatory oversight in China. Speculations exist about additional undisclosed investigations or compliance demands from the Chinese government that could impact Alibaba’s operations or financial performance.

- Ant Group Regulatory Challenges: Alibaba’s fintech arm, Ant Group, was forced to halt its IPO in 2020 and restructure following regulatory pressure. The uncertainty surrounding Ant Group’s regulatory status and potential fines or restrictions could have implications for Alibaba’s overall value.

- Financial Reporting Concerns: Some financial experts argue that Alibaba’s financial disclosures lack sufficient detail, particularly regarding its debt structure and cash flow. Undisclosed or insufficiently detailed information could indicate hidden liabilities or risks that might impact future performance.

Undisclosed or under-reported regulatory and financial issues can lead to significant risks for Alibaba’s stockholders. Without transparency in these areas, investors may face unexpected losses if adverse information surfaces or additional regulatory actions are taken.

Conclusion

This criminalistic report highlights areas where Alibaba’s practices raise potential compliance and transparency concerns. Investors should be cautious and consider the following:

Due Diligence: Alibaba’s complex structure, opaque reporting, and past regulatory challenges require investors to conduct thorough due diligence, particularly concerning its financial disclosures and management practices.