Manipulation on the financial market

Market manipulation by investment funds is a complex and controversial issue that involves a variety of activities aimed at artificially influencing the prices of financial instruments in order to make a profit. The following is a detailed discussion of the most common manipulative techniques and their potential consequences.

Funds hold 25% of all assets on Earth

Investment funds play a significant role in the global financial ecosystem, managing substantial portions of the world’s wealth. To understand their influence, it’s essential to compare the assets under management (AUM) by these funds to the total global wealth.

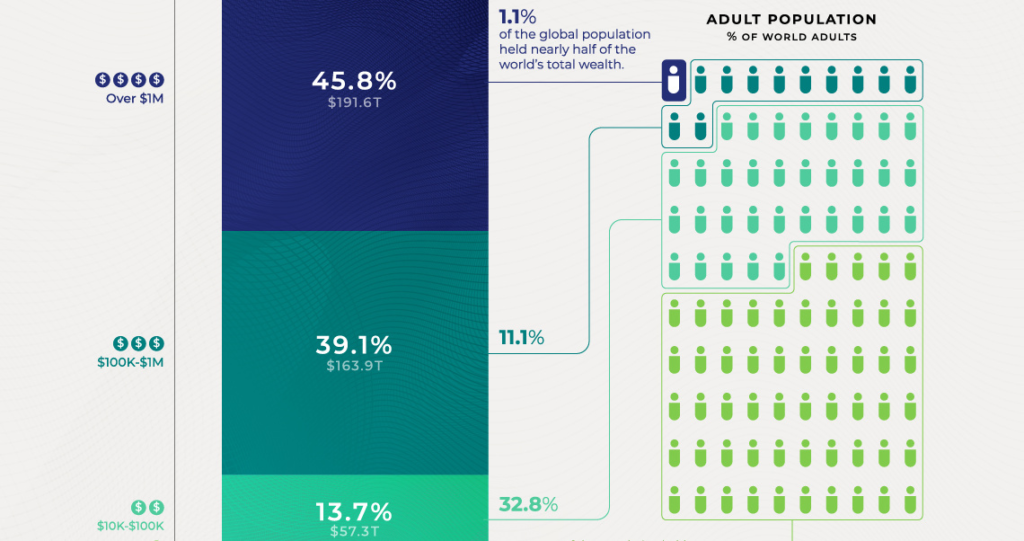

Global Wealth Overview

As of 2023, the total global wealth was estimated at approximately $463.6 trillion. This figure encompasses all assets held by individuals worldwide, including real estate, financial assets, and other valuables.

Assets Under Management by Investment Funds

Investment funds, including mutual funds, hedge funds, and private equity, collectively manage a significant portion of global wealth. According to PwC’s 2023 Global Asset & Wealth Management Survey, global assets under management fell to $115.1 trillion in 2022, nearly 10% below the 2021 high of $127.5 trillion.

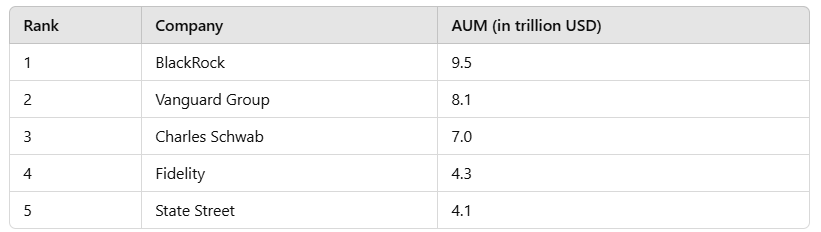

Leading Investment Funds by Assets Under Management

The largest investment management companies worldwide by assets under management (AUM):

Comparison and Analysis

When comparing the AUM of investment funds to the total global wealth:

- Total Global Wealth (2023): $463.6 trillion

- Total AUM by Investment Funds (2022): $115.1 trillion

This indicates that investment funds manage approximately 24.8% of the world’s total wealth.

Visual Representation

To provide a clearer perspective, the following pie chart illustrates the distribution of global wealth:

Source: https://www.visualcapitalist.com/visual-breakdown-world-wealth/

Conclusion

Investment funds play a pivotal role in the global financial ecosystem, managing a substantial portion of the world’s wealth. As of 2023, the total global wealth was estimated at approximately $463.6 trillion. Investment funds, including mutual funds, hedge funds, and private equity, collectively manage a significant portion of this wealth. According to PwC’s 2023 Global Asset & Wealth Management Survey, global assets under management fell to $115.1 trillion in 2022, nearly 10% below the 2021 high of $127.5 trillion. This indicates that investment funds manage approximately 24.8% of the world’s total wealth.

Market manipulation by investment funds

Market manipulation by investment funds is a complex and controversial issue involving various actions aimed at artificially influencing the prices of financial instruments for profit. Below is a detailed overview of the most commonly employed manipulative techniques and their potential consequences.

1. Wash Trading

Wash trading involves simultaneously buying and selling the same financial instruments by the same market participant or affiliated entities without any actual change in market position. The goal is to artificially increase trading volume, misleading other investors about the liquidity and attractiveness of a particular asset.

Example: An investment fund places buy and sell orders for the same number of shares of Company X within a short time frame, not altering its position but increasing market trading volume.

2. Spoofing

Spoofing entails placing large buy or sell orders without the intention of executing them, aiming to artificially influence the price of a financial instrument. Once the desired effect is achieved, these orders are withdrawn.

Example: A fund places a large sell order for shares of Company Y, causing its price to drop. The fund then buys these shares at the lower price and withdraws the sell order, leading the price to return to its previous level.

3. Layering

Layering is an advanced form of spoofing, involving placing multiple buy or sell orders at different price levels to create a false impression of demand or supply. The aim is to manipulate the price of a financial instrument in the desired direction.

Example: A fund places a series of buy orders at various price levels below the current market price, creating the illusion of strong demand, which may prompt other investors to raise the price.

4. Painting the Tape

Painting the tape involves executing transactions between affiliated entities to artificially raise the price of a financial instrument and create the appearance of market activity.

Example: Two investment funds, acting in concert, conduct buy and sell transactions of the same shares between themselves at increasingly higher prices, potentially attracting other investors who believe in an upward trend.

5. Cornering the Market

Cornering the market is a strategy involving gaining control over the supply of a particular financial instrument, allowing for price manipulation.

Example: A fund purchases the majority of available futures contracts for a specific commodity, enabling it to dictate prices and achieve significant profits at the expense of other market participants.

6. Front Running

Front running involves using information about client orders to execute one’s own transactions ahead of them, allowing for profit at the clients’ expense.

Consequences of Market Manipulation

Manipulative actions lead to distortions in market mechanisms, which can result in:

- Loss of investor confidence: Investors aware of potential manipulation may avoid investing in a particular market, reducing its liquidity and efficiency.

- Unfair capital allocation: Price manipulation can lead to erroneous investment decisions and inefficient resource distribution in the economy.

- Legal sanctions: Regulatory bodies worldwide, such as the U.S. Securities and Exchange Commission (SEC) or the Polish Financial Supervision Authority (KNF), monitor markets and impose severe penalties on entities engaging in manipulation.

It’s important to note that while investment funds possess significant resources and advanced investment techniques, their activities are regulated by appropriate financial supervisory authorities to prevent market manipulation and ensure fairness in financial markets.

The use of algorithms by investment funds

In the contemporary financial landscape, investment funds increasingly rely on sophisticated algorithms and advanced technologies to inform and execute their investment decisions. These algorithmic strategies are designed to process vast amounts of data at high speeds, enabling funds to capitalize on market opportunities that are often imperceptible to human traders. Below is an in-depth exploration of the primary algorithmic approaches employed by investment funds.

1. High-Frequency Trading (HFT) Algorithms

High-Frequency Trading involves the execution of a large number of trades at extremely high speeds, often within microseconds. HFT algorithms exploit minute price discrepancies across markets or financial instruments, aiming to generate profits from these fleeting opportunities.

- Mechanism: HFT systems utilize ultra-low latency networks and high-speed data feeds to access market information milliseconds ahead of competitors. By leveraging this speed advantage, HFT firms can execute trades before price discrepancies are corrected, capturing arbitrage profits.

- Impact on Markets: While HFT can enhance market liquidity by increasing the volume of trades, it has also been associated with market instability. Instances such as the “Flash Crash” of 2010, where the Dow Jones Industrial Average plummeted nearly 1,000 points within minutes, have raised concerns about the potential destabilizing effects of HFT. Investopedia

2. Arbitrage Algorithms

Arbitrage algorithms seek to exploit price differences of identical or similar financial instruments across different markets or forms. The objective is to achieve risk-free profits by simultaneously buying and selling the asset in different markets.

- Types of Arbitrage:

- Spatial Arbitrage: Involves capitalizing on price differences of the same asset in different geographical markets.

- Temporal Arbitrage: Focuses on price discrepancies over time, such as between spot and futures markets.

- Challenges: The proliferation of algorithmic trading has led to increased market efficiency, thereby reducing the frequency and magnitude of arbitrage opportunities. Consequently, arbitrage strategies now require more sophisticated algorithms and faster execution to remain profitable.

3. Artificial Intelligence (AI) and Machine Learning (ML) Algorithms

AI and ML algorithms analyze extensive datasets to identify patterns and predict market movements. These models can adapt to new information, improving their predictive accuracy over time.

- Applications:

- Sentiment Analysis: Processing news articles, social media feeds, and other textual data to gauge market sentiment and inform trading decisions.

- Predictive Modeling: Forecasting asset prices based on historical data and identified patterns.

- Limitations: The effectiveness of AI and ML models is contingent upon the quality and relevance of the data used for training. Moreover, these models may struggle to adapt to unprecedented market events or structural changes in the market.

Risks Associated with Algorithmic Trading

While algorithmic trading offers significant advantages in terms of speed and efficiency, it also introduces certain risks, particularly concerning potential market manipulation.

- Quote Stuffing: This manipulative tactic involves rapidly placing and then canceling a large number of orders to flood the market with quotes. The objective is to create confusion and slow down competitors’ trading systems, thereby gaining a pricing edge. Quote stuffing can disrupt market functioning and has been identified as a form of market manipulation. Investopedia

- Regulatory Scrutiny: Regulatory bodies have implemented measures to monitor and curb manipulative practices associated with algorithmic trading. For instance, the European Parliament has endorsed regulations that consider certain high-frequency trading strategies, such as quote stuffing, as market manipulation. European Commission

In conclusion, the integration of advanced algorithms into investment fund strategies has transformed trading practices, offering enhanced efficiency and the ability to process complex data at unprecedented speeds. However, these advancements also necessitate vigilant oversight to mitigate risks associated with market manipulation and to ensure the integrity of financial markets.

Own capital or other people’s capital?

Investment funds primarily manage capital entrusted to them by individual and institutional investors. Their objective is to grow this capital in line with a defined investment strategy. In practice, this means that investment funds operate mainly with external capital, earning management fees and, in some cases, performance-based incentives.

Sources of Capital for Investment Funds

Investment funds raise capital from a variety of sources, including:

- Individual Investors: Retail investors contribute to mutual funds, exchange-traded funds (ETFs), and other collective investment vehicles, seeking diversified exposure to financial markets.

- Institutional Investors: Entities such as pension funds, insurance companies, endowments, and sovereign wealth funds allocate substantial capital to investment funds to achieve specific financial objectives.

The capital raised from these investors is pooled together, allowing the fund to make investments according to its strategy. In return, investors typically pay management fees, which cover the operational costs of the fund, and may also pay performance fees if the fund achieves returns above a predetermined benchmark.

Management Fees and Performance Incentives

Investment funds charge fees to compensate for their services:

- Management Fees: These are annual fees calculated as a percentage of the assets under management (AUM). They cover the costs of managing the fund, including research, administration, and operational expenses.

- Performance Fees: Also known as incentive fees, these are calculated as a percentage of the fund’s profits, typically above a specified hurdle rate. They align the interests of fund managers with those of investors by rewarding superior performance.

For example, hedge funds often operate under a “2 and 20” fee structure, where they charge a 2% management fee and a 20% performance fee on profits exceeding a certain threshold. This structure incentivizes fund managers to pursue strategies that maximize returns for investors.

Investment of Proprietary Capital

While the primary function of investment funds is to manage external capital, some funds, particularly hedge funds, also invest their own capital alongside that of their clients. This practice, known as “skin in the game,” serves to align the interests of fund managers with those of their investors.

- Alignment of Interests: By committing their own capital, fund managers demonstrate confidence in their investment strategies and share in the financial outcomes, whether gains or losses.

- Regulatory Considerations: Certain regulations may require fund managers to invest a portion of their own capital to ensure accountability and mitigate potential conflicts of interest.

For instance, under the Alternative Investment Fund Managers Directive (AIFMD) in the European Union, fund managers are required to maintain sufficient own funds to cover potential professional liability risks. This requirement ensures that managers have a financial stake in the fund’s performance, promoting prudent risk management.

Conclusion

Investment funds predominantly manage capital provided by external investors, earning fees for their services. However, by investing their own capital, fund managers can better align their interests with those of their clients, fostering a shared commitment to the fund’s success. This practice enhances investor confidence and promotes responsible fund management.

Can an individual investor beat an investment fund?

The question of whether an individual investor can outperform an investment fund over a one-year period is multifaceted and depends on various factors, including the investor’s knowledge, experience, resources, and market conditions. While investment funds typically have advantages such as teams of analysts, advanced tools, and access to extensive information, individual investors possess certain unique strengths that can potentially lead to superior performance.

Flexibility and Agility:

Rapid Portfolio Adjustments: Individual investors can swiftly modify their portfolios without the constraints associated with large transaction volumes that funds may face. This agility allows them to capitalize on emerging opportunities or mitigate risks promptly.

Niche Market Investments: They can focus on less liquid assets or niche markets that may be overlooked by large funds due to size constraints or investment mandates. This can lead to discovering undervalued opportunities.

Cost Efficiency:

Absence of Management Fees: Individual investors do not incur management fees or performance-based charges that are typical in investment funds. This absence of fees can enhance net returns over time.

Lower Transaction Costs: With the advent of discount brokers and commission-free trading platforms, individual investors can execute trades at minimal or no cost, further improving their investment efficiency.

Tailored Decision-Making: Individual investors have the autonomy to make investment decisions aligned with their personal financial goals, risk tolerance, and investment horizons, without the need to adhere to a fund’s specific strategy or constraints.

Long-Term Perspective: They can adopt a long-term investment approach without the pressure of quarterly performance evaluations that fund managers often face, allowing for a focus on sustainable growth.

Access to Research: Investment funds have dedicated teams of analysts and access to proprietary research and data, providing them with a comprehensive understanding of market dynamics. Individual investors may lack such extensive resources.

Market Influence: Funds can leverage their significant capital to influence market movements and negotiate favorable terms, an advantage not available to individual investors.

Behavioral Biases:

Emotional Decision-Making: Individual investors may be more susceptible to emotional biases, such as fear and greed, leading to impulsive decisions that can adversely affect investment performance.

Overconfidence: A tendency to overestimate one’s investment acumen can result in excessive trading and increased exposure to risk.

Empirical Evidence:

Studies have shown that while many individual investors underperform the market due to factors like overtrading and lack of diversification, a subset of skilled and disciplined individual investors can achieve returns that surpass those of investment funds. For instance, research indicates that certain individual investors exhibit strong persistence in performance, with top performers earning risk-adjusted returns significantly above average.

Conclusion:

While it is challenging for individual investors to consistently outperform investment funds, it is not impossible. Success requires a combination of thorough market analysis, disciplined investment strategies, cost-consciousness, and the ability to manage behavioral biases. By leveraging their inherent advantages and committing to continuous learning, individual investors can enhance their potential to achieve superior investment outcomes.

The impact of investment funds on companies

Investment funds play a pivotal role in shaping the trajectories of companies by providing capital and actively engaging in corporate governance. Their influence can be both constructive and detrimental, depending on their investment strategies and objectives.

Capital Provision:

Investment funds supply essential capital that enables companies to pursue growth initiatives, research and development (R&D), and market expansion. For instance, venture capital funds often invest in technology startups, facilitating innovation and rapid growth.

Enhancement of Corporate Governance:

Activist investment funds may advocate for reforms in a company’s management structure, promoting transparency, efficiency, and accountability. Such interventions can increase shareholder value and benefit all stakeholders.

Negative Impacts:

Short-Term Focus:

Some investment funds may exert pressure on company management to achieve quick profits, potentially at the expense of long-term stability. This can lead to cost-cutting measures, layoffs, or the sale of key assets, which may weaken the company’s competitive position over time.

Aggressive Acquisition Strategies: Private equity or hedge funds may seek to gain control of a company against the wishes of its management, often leading to restructuring, asset liquidation, or even the dissolution of the company. Such actions can be detrimental to employees, suppliers, and local communities.

Success Story:

Sequoia Capital’s investment in Apple Inc. during the 1970s provided the necessary capital for development, contributing to Apple’s transformation into a global technology leader.

The acquisition of Toys “R” Us by a consortium of private equity funds in 2005 resulted in significant debt for the company. The high debt servicing costs, coupled with unfavorable market conditions, led to the company’s bankruptcy in 2017.

In summary, investment funds have the potential to both support and destabilize companies. The impact largely depends on the fund’s investment strategy and the manner in which it engages with the company’s operations.

Summary

Investment funds are pivotal in the financial markets, influencing asset prices, corporate strategies, and investor outcomes. Their operations encompass sophisticated techniques, advanced algorithms, and strategic capital deployment, all of which have significant implications for individual investors and companies alike.

Market Manipulation by Investment Funds

Investment funds may engage in practices that can distort market prices to their advantage. Techniques such as wash trading, spoofing, layering, painting the tape, cornering the market, and front running are employed to create misleading market signals. These actions can undermine market integrity, leading to a loss of investor confidence and potential legal repercussions. Regulatory bodies like the U.S. Securities and Exchange Commission (SEC) actively monitor and penalize such manipulative behaviors to maintain fair and transparent markets.

Utilization of Algorithms by Investment Funds

Modern investment funds increasingly rely on advanced algorithms to enhance trading efficiency and decision-making processes. High-Frequency Trading (HFT) algorithms execute numerous transactions within microseconds, capitalizing on minute price discrepancies. Arbitrage algorithms exploit price differences across markets or instruments to achieve risk-free profits. Additionally, Artificial Intelligence (AI) and Machine Learning (ML) algorithms analyze vast datasets to identify patterns and predict market movements. While these technologies offer competitive advantages, they also introduce risks, including potential market manipulation and systemic vulnerabilities.

Proprietary vs. External Capital

Investment funds primarily manage capital entrusted by individual and institutional investors, earning management and performance fees for their services. However, some funds, particularly hedge funds, also invest their own capital alongside that of their clients. This practice, known as “skin in the game,” aligns the interests of fund managers with those of investors, fostering a shared commitment to the fund’s success. Regulatory frameworks often mandate such practices to ensure accountability and prudent risk management.

Individual Investors vs. Investment Funds

While investment funds benefit from extensive resources, expertise, and access to information, individual investors possess unique advantages. Their flexibility allows for rapid portfolio adjustments and the ability to invest in niche markets. Additionally, individual investors avoid management fees, potentially enhancing net returns. However, outperforming investment funds consistently requires substantial knowledge, experience, and disciplined investment strategies. Empirical evidence suggests that while many individual investors underperform the market, a subset of skilled and disciplined individuals can achieve superior returns.

Impact of Investment Funds on Companies

Investment funds significantly influence the destinies of companies through capital provision and active engagement in corporate governance. Positive impacts include supplying essential capital for growth and promoting transparency and accountability in management. Conversely, funds may exert pressure for short-term gains, potentially compromising long-term stability. Hostile takeovers and aggressive restructuring by certain funds can also lead to adverse outcomes for employees, suppliers, and local communities. The overall impact depends on the fund’s investment strategy and its approach to corporate involvement.

In conclusion, investment funds are integral to the financial ecosystem, wielding considerable influence over markets and companies. Their sophisticated operations offer both opportunities and challenges, necessitating vigilant oversight and informed participation by all market stakeholders.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Source:

https://www.investopedia.com/terms/q/quote-stuffing.asp

https://investinganswers.com/dictionary/q/quote-stuffing

https://corporatefinanceinstitute.com/resources/career-map/sell-side/capital-markets/quote-stuffing/

https://www.supermoney.com/encyclopedia/quote-stuffinghttps://library.fiveable.me/key-terms/financial-technology/quote-stuffing

https://fastercapital.com/content/Quote-Stuffing–Overloading-Systems–The-Chaos-of-Quote-Stuffing.html

https://www.linklaters.com/insights/publications/aifm/capital-requirements

https://www.ccmalta.com/publications/capital-requirments-under-aifmd

https://www.fool.com/terms/q/what-is-quote-stuffing/

https://www2.deloitte.com/us/en/insights/industry/financial-services/financial-services-industry-outlooks/investment-management-industry-outlook.html

https://www.statista.com/statistics/1448946/top-sovereign-wealth-funds-worldwide-by-assets-under-management/

https://www.mckinsey.com/industries/private-capital/our-insights/mckinseys-private-markets-annual-reviewhttps://www.pwc.com/gx/en/industries/financial-services/publications/etfs-2028-shaping-the-future.html

https://www.statista.com/statistics/323928/global-assets-under-management/

https://elements.visualcapitalist.com/wp-content/uploads/2024/07/global-wealth-report.pdf

https://www.visualcapitalist.com/visual-breakdown-world-wealth/

https://pixabay.com/

https://www.pexels.com/