DeepSeek did they specifically release an app and play shorts on it ?

Basic information of both companies

High-Flyer’s Background and DeepSeek’s Launch:

- High-Flyer is described as a Chinese quantitative hedge fund founded in 2015, focusing on AI in trading strategies. It established DeepSeek in 2023 to delve into AI research, specifically targeting Artificial General Intelligence (AGI).

Market Impact and Speculation:

- The launch of DeepSeek’s AI models, notably DeepSeek-V2 and DeepSeek-R1, has been associated with a significant market reaction, including a drop in tech and AI-related stocks. This has led to speculation about market manipulation, particularly since High-Flyer is a hedge fund with a history in trading.

Evidence or Lack Thereof:

- No direct evidence from the provided sources explicitly shows High-Flyer engaged in strategic short-selling based on DeepSeek’s launch.

- There are no official statements, financial disclosures, or regulatory actions cited that would confirm such activities.

- The success of DeepSeek’s models in benchmarks and their impact on the market are discussed, but this is more aligned with the competitive landscape of AI technology rather than market manipulation.

Speculative Theories:

- Speculative posts on X suggest that High-Flyer might have taken short positions in anticipation of market downturns triggered by DeepSeek’s announcements. However, these are theories without corroborating evidence from official sources or financial data.

Conclusion:

- The speculation around DeepSeek’s launch being a move for short-selling gains by High-Flyer lacks concrete evidence in the provided information. While the timing and effects of DeepSeek’s announcements on the market are notable, attributing these to a deliberate strategy for short-selling remains unproven. For solid evidence, one would need to look at High-Flyer’s trading activities, regulatory filings, or statements from the companies involved, which are not available here.

High-Flye investment fund connections

- Liang Wenfeng: He is the founder of both High-Flyer and DeepSeek. Liang Wenfeng studied AI at Zhejiang University and was involved with High-Flyer before founding DeepSeek. His role in both companies is a direct connection.

- Lu Zhengzhe: Although not the founder of DeepSeek, Lu Zhengzhe is the CEO of High-Flyer Quant, which is mentioned as the parent and funder of DeepSeek. His leadership at High-Flyer indicates a strategic and operational link between the two entities. However, he is not directly linked to DeepSeek in terms of founding or leading the AI research.

- Personnel Overlap: DeepSeek has been noted for hiring new graduates or those early in their AI careers, often from within China, with a preference for ability over experience. While there’s no explicit mention of these individuals being directly from High-Flyer, the shared location in Hangzhou and the connection through Liang Wenfeng suggest there might be personnel who transitioned or work in both contexts, especially considering High-Flyer’s early involvement in AI for trading which could have provided a talent pool for DeepSeek.

- Physical Proximity: Both companies are based in Hangzhou, Zhejiang, which could facilitate shared personnel or resources. There’s a mention that High-Flyer and DeepSeek share an office building, further suggesting operational and personnel connections.

- Shared Goals and Resources: High-Flyer’s AI unit and its involvement in DeepSeek’s creation, particularly in terms of funding and providing initial compute resources like GPUs, indicate a deep integration between the companies. High-Flyer’s strategic move into AI research through DeepSeek is evident, with the hedge fund’s resources being utilized for DeepSeek’s development.

Addresses for DeepSeek and High-Flyer

- DeepSeek:

- High-Flyer:

- High-Flyer is based in Hangzhou, Zhejiang, China. However, there is no specific street address provided for High-Flyer in the given information.

Speculative informations

- Funding and Cost Speculation: There’s widespread speculation regarding the actual cost of training DeepSeek’s models. While DeepSeek claimed to have spent less than $6 million on training DeepSeek-V3, some skeptics believe the costs might have been significantly higher, possibly leveraging High-Flyer’s resources or undisclosed advanced hardware. This speculation arises from the belief that achieving such performance at the stated cost would be unusually efficient.

- Hardware Acquisition: There’s debate around how much hardware, particularly Nvidia GPUs, DeepSeek used for training. Some sources suggest DeepSeek might have used significantly more than disclosed, potentially circumventing U.S. export controls through alternative supply chains, which would imply a much higher investment than publicly stated.

- Market Manipulation Theories: Posts on X have speculated that High-Flyer might have used DeepSeek’s launch to manipulate the market, particularly by taking short positions on tech stocks that would be affected by DeepSeek’s announcements. The theory posits that the hedge fund could profit from the market’s reaction to DeepSeek’s competitive claims and low-cost model development.

- Long-term Strategy: Speculation also includes whether DeepSeek was part of a long-term strategy by High-Flyer to not only push AI development but also to establish a position in the AI market that could be leveraged for future financial gains, either through direct AI applications or through influencing market dynamics.

- Political and Economic Implications: There’s commentary about how DeepSeek’s success might be seen in the context of U.S.-China tech rivalry, with some posts suggesting that China’s progress in AI could be part of a broader strategic move to challenge U.S. tech dominance. This isn’t strictly speculative about DeepSeek’s financial strategies but adds to the narrative around its significance.

Ownerhsip

Liang Wenfeng is the founder of both DeepSeek and High-Flyer, thus directly connecting the two companies at the executive level.

Operational Connections:

DeepSeek is described as being owned and operated by both Hangzhou DeepSeek Artificial Intelligence Co., Ltd. and Beijing DeepSeek Artificial Intelligence Co., Ltd., with High-Flyer as a significant backer. This indicates shared resources or strategic alignment, possibly including personnel, funding, or technology.

High-Flyer Capital Management has a direct financial stake in DeepSeek, funding its operations and likely influencing its strategic direction due to shared leadership.

The existence of both Hangzhou and Beijing DeepSeek entities suggests a strategic expansion or division of operations, possibly to leverage different regional advantages or to scale operations more effectively.

Main Shareholder:

- High-Flyer Capital Management: Is the primary shareholder of DeepSeek. High-Flyer is a hedge fund that founded and funds DeepSeek.

- DeepSeek: There is no additional information on other significant shareholders beyond High-Flyer. DeepSeek is represented as being wholly owned by High-Flyer.

Connections with Other Companies:

- High-Flyer Capital Management has two subsidiaries regulated by AMAC (Asset Management Association of China):

- Zhejiang High-Flyer Asset Management Co., Ltd.

- Ningbo High-Flyer Quant Investment Management Partnership LLP

- DeepSeek operates under two entities:

- Hangzhou DeepSeek Artificial Intelligence Co., Ltd.

- Beijing DeepSeek Artificial Intelligence Co., Ltd.

There’s no explicit information in the provided sources about other companies connected to DeepSeek beyond High-Flyer, but the structure with two locations (Hangzhou and Beijing) suggests strategic placement of operations.

Capital:

- High-Flyer Capital Management: Manages assets worth approximately 8 billion dollars. In the past, they achieved returns of 151% since 2017, indicating significant working capital and investment capabilities.

- DeepSeek: Information on capital is less clear, but it’s known that High-Flyer has invested substantial funds in DeepSeek’s development, including hardware for AI training. The cost to train the DeepSeek-V3 model was estimated at about $5.58 million, which is relatively small compared to other major AI models, though this might not reflect High-Flyer’s full financial commitment to the project.

Summary:

- High-Flyer is the main and only mentioned shareholder of DeepSeek, indicating a strong financial and strategic connection.

- High-Flyer has significant financial resources, which are used both for hedge fund operations and funding AI innovation through DeepSeek.

- There’s no information on other significant shareholders or companies related to DeepSeek beyond High-Flyer, but DeepSeek’s structure with two branches shows a strategic approach to AI development in China.

American Market Reaction

The American market’s response to DeepSeek was significant:

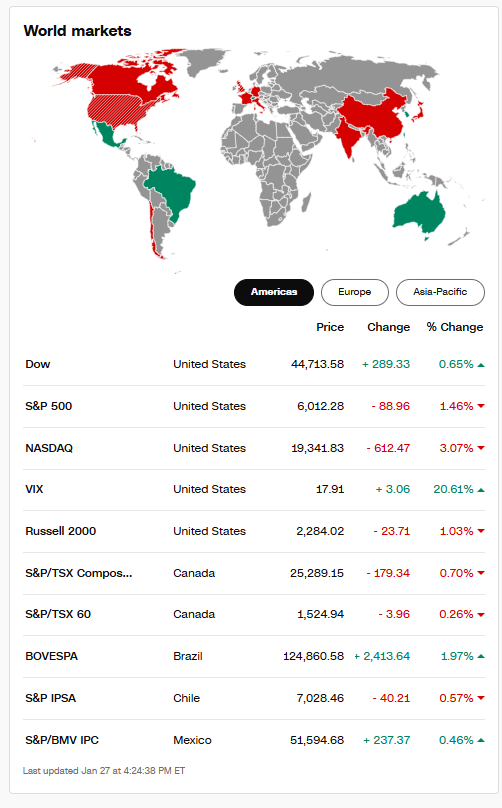

- Stock Value Decline: Following DeepSeek’s announcements, stocks of many tech companies, especially those associated with AI and chip technology, saw substantial declines. Notably:

- Nvidia: Its stock dropped by about 16-17%, marking one of the largest single-day market value drops in Wall Street history for one company.

- Other Tech Giants: Microsoft, Alphabet (Google), and Meta also experienced declines, though less dramatic, in the range of a few percentages.

- Stock Market Indices: The Nasdaq, which is particularly sensitive to tech sector fluctuations, fell more than 3% in response to the DeepSeek news.

- Speculation and Analysis: The market reacted to DeepSeek with uncertainty, with experts and investors pondering the long-term impact on the AI sector, especially regarding cost and accessibility of AI technology.

- Some analysts argue this is a short-term reaction, given the strong fundamentals of the US AI market, and investments in AI infrastructure will remain crucial.

- Others see DeepSeek as a signal of potential market dynamics shift where costs could become more competitive, and AI models more accessible.

- Reactions on X: On the platform X, some users claimed DeepSeek was overhyped, while others highlighted it as the beginning of a new era in AI, where innovation can come from anywhere in the world, not just the USA.

Conclusion:

DeepSeek’s success caused shockwaves in the American tech market, forcing investors to reconsider valuations and future strategies in the AI sector. While the short-term reaction was negative for many US firms, the long-term implications might lead to a more competitive and innovative AI landscape.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Source:

https://x.com/DeepSeekAI/status/1759762366960951772

https://x.com/fchollet/status/1759776366473797973

https://chat.deepseek.com/downloads/DeepSeek%20Terms%20of%20Use.html

https://www.highflyercapital.com/privacy-policy.html

https://x.com/noahpinion/status/1759795334948188517

https://x.com/danielgross/status/1759771146999808000

https://x.com/leogao/status/1759771929820831813

https://x.com/jimfan/status/1759777194121707806

https://x.com/DeepSeekAI/status/1759779768641802207

https://x.com/DeepSeekAI/status/1759806762173726820

https://x.com/DeepSeekAI/status/1759815239025852661

https://x.com/DeepSeekAI/status/1759823660445516261