Hindenburg Research in Numbers – The Impact of Their Investigations

Hindenburg Research, founded by Nathan Anderson in 2017, has long been a prominent name in the world of financial investigations. Specializing in uncovering corporate fraud, accounting irregularities, and misconduct in publicly traded companies, the firm made headlines with its in-depth reports that often led to significant market reactions. Known for its short-selling strategies, Hindenburg meticulously analyzed companies, identifying vulnerabilities and exposing unethical practices. With a reputation for shaking up markets and holding corporations accountable, the firm became a controversial but highly influential player in financial research. Behind its operations stood Anderson, a financial analyst with a background in forensic accounting and due diligence, whose mission was to bring transparency to the corporate world.

The Origin of the Name “Hindenburg Research”

The name “Hindenburg Research” carries a symbolic meaning that reflects the firm’s mission and approach to financial investigations. It is derived from the infamous Hindenburg disaster of 1937, when the German passenger airship LZ 129 Hindenburg tragically burst into flames upon its arrival in New Jersey. This catastrophic event has since become a powerful metaphor for high-profile collapses and failures.

Nathan Anderson, the founder of Hindenburg Research, chose the name to underscore the firm’s goal of uncovering potential “disasters” in the financial markets before they happen. Just as the Hindenburg airship’s failure was a dramatic and avoidable tragedy, the firm sought to expose companies with flawed business models, fraudulent practices, or hidden financial weaknesses, thereby preventing similar “explosions” in the corporate and investment world.

The name also aligns with Hindenburg Research’s critical, no-nonsense approach, as the firm has often been seen as a harbinger of major market corrections. Its reports, akin to early warning signals, aimed to alert investors to underlying risks that could lead to significant losses. This evocative naming choice positioned the firm as a watchdog in the financial industry, relentlessly pursuing the truth behind corporate facades.

Hindenburg in Numbers – The Impact of Their Investigations

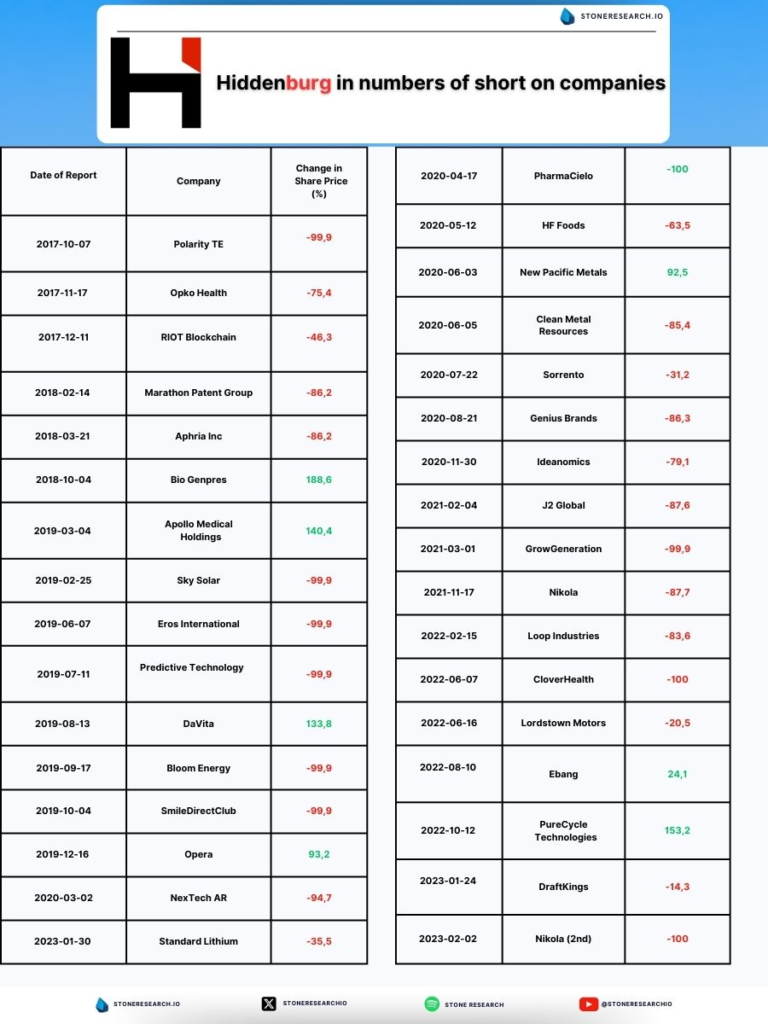

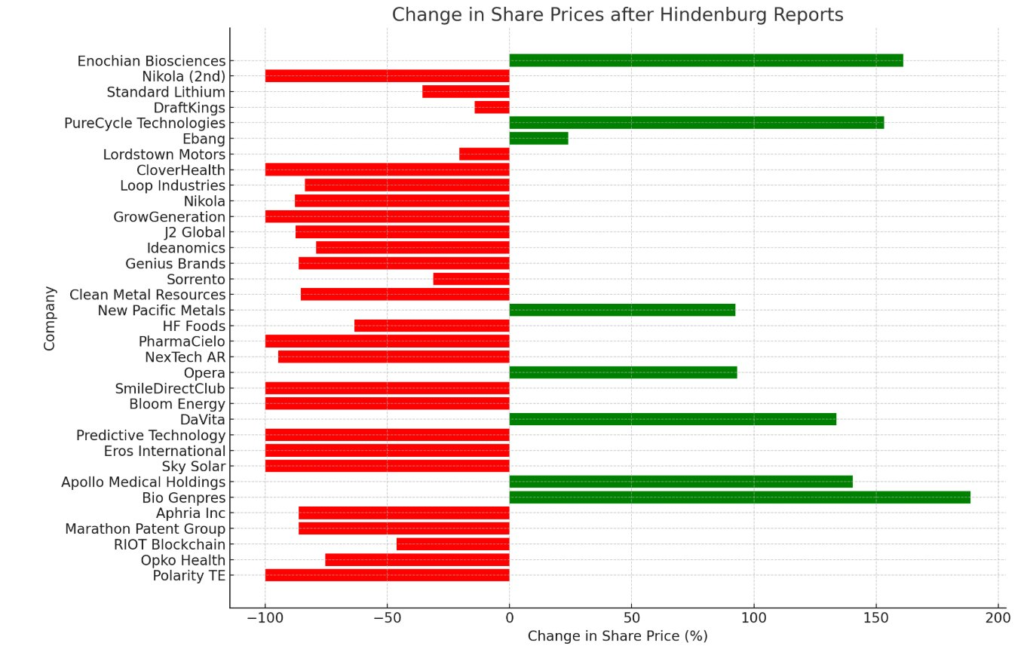

Report Dates: From 2017 to 2023

Biggest Declines: -99.9% (e.g., Polarity TE, Sky Solar, Bloom Energy, SmileDirectClub)

Biggest Gains: +188.6% (Bio Genpres) and +153.2% (PureCycle Technologies)

Hindenburg Research: Bold investigations that expose the truth about companies, uncovering deceptive practices.

Impact: Protecting investors, revealing fraud, and serving as a true inspiration in the financial world.

Declines:

- Polarity TE: -99.9%

- Opko Health: -75.4%

- RIOT Blockchain: -46.3%

- Marathon Patent Group: -86.2%

- Aphria Inc: -86.2%

- Sky Solar: -99.9%

- Eros International: -99.9%

- Predictive Technology: -99.9%

- Bloom Energy: -99.9%

- SmileDirectClub: -99.9%

- NexTech AR: -94.7%

- Standard Lithium: -35.5%

- PharmaCielo: -100%

- HF Foods: -63.5%

- Clean Metal Resources: -85.4%

- Sorrento: -31.2%

- Genius Brands: -86.3%

- Ideanomics: -79.1%

- J2 Global: -82.6%

- GrowGeneration: -99.9%

- Nikola (2021): -87.7%

- Loop Industries: -83.6%

- CloverHealth: -100%

- Lordstown Motors: -20.5%

- DraftKings: -14.3%

- Nikola (2023): -100%

Gains:

- Bio Genpres: +188.6%

- Apollo Medical Holdings: +140.4%

- DaVita: +133.8%

- New Pacific Metals: +92.5%

- Opera: +93.2%

- Ebang: +24.1%

- PureCycle Technologies: +153.2%

Huge respect to Hindenburg Research for their groundbreaking work on behalf of investors, uncovering corporate fraud, and exposing the truth behind some of the largest companies. Your contributions have made history and continue to inspire us!

Respect forever

To the entire Team at Hindenburg Research

Your relentless dedication and unparalleled investigative efforts are truly an inspiration. From the beginning, you have set an exemplary standard for research that benefits investors and the public at large. By shedding light on corporate deceptions and revealing the truth, you have made an indelible mark on the history of financial research.

The precision, courage, and integrity you bring to your work stand as a beacon of hope for those striving to uncover the truth. Your efforts have not only safeguarded investors but also held some of the largest corporations accountable, ensuring a fairer marketplace.

Thank you for your remarkable contributions and for inspiring countless individuals, including us. You are trailblazers, and we look forward to seeing more of your groundbreaking work in the future.

With admiration and gratitude,

Stone Research Team