Manipulation on the Crypto market

Cryptocurrency Market Manipulation: Understanding the Risks and Protecting Retail Investors

The cryptocurrency market, known for its rapid growth and high volatility, offers significant opportunities for investors. However, it is also susceptible to various forms of market manipulation that can lead to substantial financial losses, especially for retail investors. This article delves into common manipulation tactics in the crypto market and provides strategies to safeguard investments.

Common Forms of Cryptocurrency Market Manipulation

Pump and Dump Schemes involve artificially inflating the price of a cryptocurrency through false or misleading statements, creating a buying frenzy. Once the price reaches a peak, the manipulators sell off their holdings, causing the price to plummet and leaving unsuspecting investors with significant losses.

Mechanism:

- Promotion: Manipulators select a low-market-cap cryptocurrency and promote it aggressively through social media, forums, and other channels, often using false information to create hype.

- Inflation: The increased demand drives up the price, attracting more investors who fear missing out.

- Dumping: At the peak price, manipulators sell their holdings, leading to a sharp price decline.

Example: In 2018, the U.S. Securities and Exchange Commission (SEC) charged individuals involved in pump and dump schemes that defrauded investors of millions of dollars by manipulating microcap stocks, a tactic also prevalent in cryptocurrency markets.

Wash Trading involves an entity simultaneously buying and selling the same cryptocurrency to create the illusion of increased trading volume. This deceptive practice can mislead investors about the asset’s liquidity and demand.

Mechanism:

- Execution: A trader or group conducts trades with themselves or colluding parties, generating fake volume.

- Perception: The inflated volume suggests high interest and activity, attracting genuine investors.

Example:A study by the National Bureau of Economic Research found that wash trading accounted for up to 70% of the reported volume on unregulated cryptocurrency exchanges.

Spoofing is the act of placing large buy or sell orders with no intention of executing them, aiming to influence the asset’s price. Once the market reacts, the manipulator cancels the orders, profiting from the price movement.

Mechanism:

- Order Placement: Large orders are placed to create a false impression of demand or supply.

- Market Reaction: Other traders adjust their orders based on perceived market sentiment.

- Cancellation: The manipulator cancels the original orders and profits from the resulting price movement.

Example:In 2020, the Commodity Futures Trading Commission (CFTC) fined a trader for spoofing in the cryptocurrency markets, highlighting the prevalence of this tactic.

Insider Trading occurs when individuals with access to non-public information about a cryptocurrency use that knowledge to make profitable trades before the information becomes public, disadvantaging other investors.

Mechanism:

- Information Access: Insiders obtain confidential information about upcoming events affecting a cryptocurrency’s value.

- Trading: They trade based on this information before it becomes public, securing profits or avoiding losses.

Example: In 2022, a former product manager at a major cryptocurrency exchange was charged with insider trading, marking one of the first such cases in the crypto industry.

Recent Cases Highlighting Market Manipulation

- Gotbit Case: In October 2024, Aleksei Andriunin, founder of crypto market maker Gotbit, was indicted by the U.S. Department of Justice for allegedly engaging in schemes to manipulate cryptocurrency markets by creating artificial trading volumes for client companies.

- MyTrade Case: Liu Zhou, founder of MyTrade, pleaded guilty to market manipulation and wire fraud in October 2024. The company allegedly used bots for wash trading to artificially inflate token trading volumes, misleading investors.

Regulatory Measures to Combat Manipulation

Regulatory bodies worldwide are intensifying efforts to curb market manipulation in the cryptocurrency sector:

- U.S. Securities and Exchange Commission (SEC): The SEC has charged multiple companies and individuals with fraud and market manipulation, emphasizing the need for transparency and investor protection.

- European Union’s Markets in Crypto-Assets (MiCA) Regulation: MiCA aims to establish a comprehensive regulatory framework for crypto-assets, including measures to prevent insider dealing, unlawful disclosure of inside information, and market manipulation.

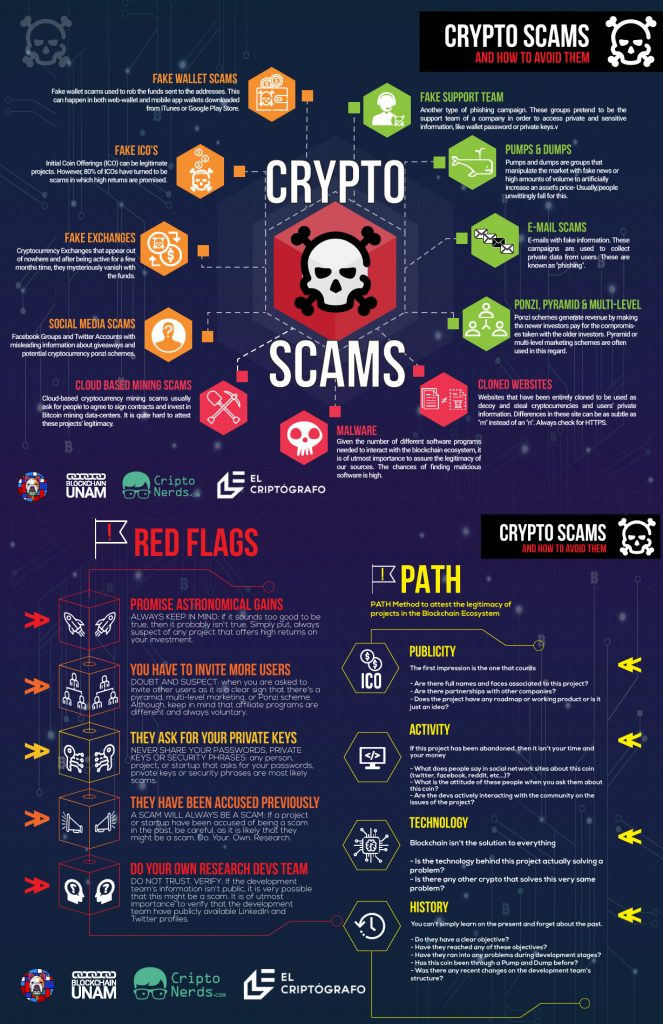

Source: https://allcrypto.com/how-to-identify-crypto-scams-infographic/

Strategies for Retail Investors to Protect Themselves

Conduct Thorough ResearchBefore investing, perform comprehensive due diligence on the cryptocurrency, its development team, market demand, and underlying technology. Be cautious of projects with limited transparency or unclear objectives.

Be Skeptical of Unsolicited AdviceExercise caution with investment tips from unknown sources, especially on social media platforms. Scammers often use these channels to promote pump and dump schemes.

Monitor Market IndicatorsStay vigilant for unusual trading patterns, such as sudden spikes in volume or price without clear reasons, which may indicate manipulative activities.

Use Reputable ExchangesTrade on well-established and regulated cryptocurrency exchanges that implement robust security measures and comply with regulatory standards.

Diversify InvestmentsAvoid putting all funds into a single cryptocurrency. Diversifying your portfolio can mitigate risks associated with the volatility and potential manipulation of individual assets.

Stay Informed About RegulationsKeep abreast of the latest regulatory developments in the cryptocurrency space, as compliance requirements and legal protections are continually evolving.

Conclusion

While the cryptocurrency market presents lucrative opportunities, it is also fraught with risks stemming from various forms of market manipulation. Retail investors must remain vigilant, educate themselves about common manipulative tactics, and adopt prudent investment strategies to protect their assets. Regulatory bodies are making strides to enhance market integrity, but individual awareness and caution remain paramount in navigating the crypto landscape.

Forensic Analysis of Notable Cryptocurrency Scams and Their Mechanisms

The cryptocurrency market, while offering substantial investment opportunities, has also been a fertile ground for various fraudulent schemes. This forensic analysis examines several prominent cryptocurrency scams, detailing their mechanisms and the impact on investors.

Source: https://bitcoinist.com/everything-you-need-to-know-about-mt-gox/

BitConnect (2016–2018)

Overview: BitConnect was a cryptocurrency lending and exchange platform that promised high returns through a proprietary trading bot and volatility software.

Mechanism:

- Ponzi Scheme: BitConnect offered returns of up to 1% per day, which were unsustainable. Early investors were paid with funds from new investors, a classic Ponzi structure.

- Referral Program: The platform incentivized users to recruit others, creating a multi-level marketing system that expanded its reach.

Outcome: In January 2018, BitConnect abruptly shut down its lending and exchange services, leading to significant financial losses for investors. Regulatory warnings and cease-and-desist orders preceded its closure.

OneCoin (2014–2017)

Overview: OneCoin was marketed as a cryptocurrency and educational platform, claiming to be the next Bitcoin.

Mechanism:

- Non-Existent Blockchain: Unlike legitimate cryptocurrencies, OneCoin lacked a blockchain, meaning no actual cryptocurrency existed.

- Educational Packages: Investors purchased educational materials with tokens that were purportedly convertible to OneCoins, which had no real value.

Outcome: Authorities across multiple countries have arrested key figures associated with OneCoin. The scheme defrauded investors of approximately $4 billion.

PlusToken (2018–2019)

Overview: PlusToken was presented as a high-yield investment program and wallet service, primarily targeting Asian markets.

Mechanism:

- High Returns Promise: The platform promised monthly returns between 9% and 18%, attracting a large user base.

- Exit Scam: In mid-2019, operators absconded with an estimated $2 billion in cryptocurrencies, leaving investors unable to withdraw their funds.

Outcome: Chinese authorities arrested several individuals connected to PlusToken. The scam highlighted vulnerabilities in the rapidly growing cryptocurrency market.

WoToken (2018–2019)

Overview: Similar to PlusToken, WoToken was a wallet service that promised high returns through algorithmic trading.

Mechanism:

- Multi-Level Marketing: Users were incentivized to recruit others, earning commissions from their investments.

- Fake Trading Profits: The platform claimed to generate profits through trading, but these were fabricated.

Outcome: Chinese courts sentenced key operators to prison and fined them. The scheme defrauded investors of over $1 billion.

MT. Gox (2011–2014)

Overview: MT. Gox was once the largest Bitcoin exchange, handling over 70% of all Bitcoin transactions worldwide.

Mechanism:

- Security Lapses: The exchange suffered from poor security practices, making it vulnerable to hacks.

- Mismanagement: Internal mismanagement and lack of transparency exacerbated the issues.

Outcome: In 2014, MT. Gox filed for bankruptcy after losing approximately 850,000 Bitcoins, valued at around $450 million at the time. The incident led to increased scrutiny and calls for better regulation of cryptocurrency exchanges.

Thodex (2021)

Overview: Thodex was a Turkish cryptocurrency exchange that abruptly halted trading and withdrawals in April 2021.

Mechanism:

- Exit Scam: The CEO fled the country, allegedly taking with him $2 billion in investor funds.

- Promotional Campaigns: The exchange attracted users through aggressive marketing and promotional offers.

Outcome: Turkish authorities issued international warrants for the arrest of the CEO and detained several employees. The incident underscored the risks associated with unregulated exchanges.

Africrypt (2021)

Overview: Africrypt was a South African investment platform that promised high returns through cryptocurrency trading.

Mechanism:

- Alleged Hack: The founders claimed the platform was hacked, resulting in the loss of $3.6 billion in Bitcoin.

- Suspicious Behavior: Investors were advised not to pursue legal action, raising suspicions of an exit scam.

Outcome: The founders disappeared, and investigations are ongoing. The case highlights the need for due diligence when investing in cryptocurrency platforms.

Terra-Luna Collapse (2022)

Overview: Terra was a blockchain protocol that supported the algorithmic stablecoin TerraUSD (UST), designed to maintain a 1:1 peg with the U.S. dollar. Luna was the native cryptocurrency used to stabilize UST’s price.

Mechanism:

- Algorithmic Stabilization: UST’s stability relied on a mint-and-burn mechanism with Luna. When UST’s price deviated from $1, arbitrage opportunities were supposed to restore the peg by adjusting the supply of UST and Luna.

- Anchor Protocol: A decentralized finance (DeFi) platform offering up to 20% annual returns on UST deposits, attracting significant investments.

Collapse: In May 2022, UST lost its peg to the dollar, leading to a “death spiral” where both UST and Luna plummeted in value. The collapse wiped out approximately $45 billion in market capitalization within a week. The event highlighted the vulnerabilities of algorithmic stablecoins and had widespread repercussions in the crypto market.

Outcome: In April 2024, a New York jury found Terraform Labs and its co-founder Do Kwon liable for defrauding cryptocurrency investors, leading to a $40 billion market loss. The verdict followed a nine-day Manhattan federal court trial and was seen as a victory for the U.S. Securities and Exchange Commission (SEC) amidst its crackdown on the cryptocurrency industry.

The cryptocurrency market, while offering substantial investment opportunities, has also been a fertile ground for various fraudulent schemes. This forensic analysis examines several prominent cryptocurrency scams, detailing their mechanisms and the impact on investors.

Protecting Yourself from Cryptocurrency Scams: A Comprehensive Guide for Investors

Investing in cryptocurrencies offers significant opportunities but also carries risks, particularly concerning fraudulent schemes. To safeguard your investments, consider the following steps

Conduct Thorough Due Diligence:

- Whitepaper Analysis: Review the project’s whitepaper to understand its objectives, technology, and roadmap. Ensure the information is clear and realistic.

- Team Evaluation: Investigate the experience and reputation of the development team. Transparency and a solid track record in the blockchain industry are crucial.

- Partnership Verification: Confirm any claimed partnerships with reputable companies or institutions.

Assess Tokenomics:

- Token Distribution: Examine how tokens are allocated among the team, investors, and the community. Uneven distribution may indicate potential issues.

- Token Utility: Ensure the token has a practical use within the project’s ecosystem.

Evaluate Community Engagement:

- Social Media Activity: Monitor the project’s presence on platforms like Twitter, Telegram, and Reddit. An active and growing community is a positive indicator.

- Feedback and Reviews: Seek out reviews and opinions from other investors and industry experts.

Ensure Security Audits:

- Code Audit: Verify that the project has undergone an independent code audit by a reputable firm. The absence of an audit may suggest security vulnerabilities.

Verify Financial Transparency:

- Financial Reports: Check if the project regularly publishes financial statements and progress updates.

- Reserve Funds: Ensure the project maintains adequate financial reserves for unforeseen circumstances.

Confirm Regulatory Compliance:

- Licenses and Permits: Determine whether the project operates in accordance with local regulations and holds necessary licenses.

- Company Registration: Ensure the company is registered in a jurisdiction with robust legal frameworks.

Be Wary of Unrealistic Returns:

- Set Realistic Expectations: Avoid projects promising guaranteed, high returns in a short period, as such claims often signal fraud.

Use Reputable Platforms:

- Exchanges: Invest through well-established and regulated cryptocurrency exchanges.

- Wallets: Utilize trusted wallets with positive user feedback.

Commit to Continuous Education:

- Training: Regularly enhance your knowledge of cryptocurrencies and blockchain technology.

- Stay Informed: Keep up with the latest trends and potential threats in the industry.

Exercise Caution Against Phishing and Online Scams:

- Source Verification: Always verify the authenticity of websites and emails related to investments.

- Data Security: Never share your private keys or login credentials with third parties.

By implementing these measures, you can reduce the risk of falling victim to scams and make informed investment decisions in the cryptocurrency space.

Summary

Investing in cryptocurrencies presents both significant opportunities and inherent risks, particularly concerning fraudulent schemes. To safeguard your investments, it’s crucial to conduct thorough due diligence. Begin by analyzing the project’s whitepaper to understand its objectives, technology, and roadmap, ensuring the information is clear and realistic. Investigate the experience and reputation of the development team, emphasizing transparency and a solid track record in the blockchain industry. Confirm any claimed partnerships with reputable companies or institutions to validate the project’s credibility.

Assessing tokenomics is equally important. Examine how tokens are allocated among the team, investors, and the community, as uneven distribution may indicate potential issues. Ensure the token has practical utility within the project’s ecosystem to justify its value. Evaluate community engagement by monitoring the project’s presence on platforms like Twitter, Telegram, and Reddit; an active and growing community is a positive indicator. Seek out reviews and opinions from other investors and industry experts to gain diverse perspectives.

Security is paramount. Verify that the project has undergone an independent code audit by a reputable firm, as the absence of an audit may suggest vulnerabilities. Check if the project regularly publishes financial statements and progress updates to demonstrate transparency. Ensure the project maintains adequate financial reserves for unforeseen circumstances, indicating prudent financial management.

Confirm that the project operates in accordance with local regulations and holds necessary licenses, ensuring compliance and reducing legal risks. Be cautious of projects promising guaranteed, high returns in a short period, as such claims often signal fraud. Invest through well-established and regulated cryptocurrency exchanges, and utilize trusted wallets with positive user feedback to protect your assets.

Commit to continuous education by regularly enhancing your knowledge of cryptocurrencies and blockchain technology. Stay informed about the latest trends and potential threats in the industry to make informed decisions. Always verify the authenticity of websites and emails related to investments, and never share your private keys or login credentials with third parties to prevent unauthorized access.

By implementing these measures, you can reduce the risk of falling victim to scams and make informed investment decisions in the cryptocurrency space. If you require assistance in researching and evaluating a specific project, please feel free to contact us.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Source

https://ethereum.org/en/security/

https://us.norton.com/blog/how-to/cryptocurrency-scams

https://www.moonpay.com/learn/cryptocurrency/how-to-spot-and-prevent-cryptocurrency-scams

https://beincrypto.com/learn/crypto-scams/

https://www.pandasecurity.com/en/mediacenter/cryptocurrency-scams/

https://us.norton.com/blog/privacy/cryptocurrency-security

https://consumer.ftc.gov/consumer-alerts/2021/05/spotting-cryptocurrency-investment-scams

https://www.comparitech.com/crypto/avoid-bitcoin-scams/

https://consumer.ftc.gov/articles/what-know-about-cryptocurrency-and-scams

https://www.kaspersky.com/resource-center/preemptive-safety/guide-to-cryptocurrency-safety

https://coinledger.io/learn/how-to-avoid-crypto-scam

https://pixabay.com/

https://www.pexels.com/