Research 1INCH: DEX Aggregator

From the beginning

The 1inch.io project is a leading decentralized exchange (DEX) aggregator in the DeFi ecosystem, aimed at optimizing transactions on decentralized markets by aggregating liquidity from multiple sources. Through its advanced Pathfinder algorithm, which analyzes thousands of transaction routes, 1inch minimizes price slippage and reduces fees, while the Limit Order Protocol allows users to place limit orders in a decentralized manner. From a business perspective, the project seeks to boost DeFi adoption by simplifying the transaction process and integrating with multiple blockchain networks, enabling expansion into new markets.

The founding team, composed of Sergej Kunz and Anton Bukov, is well-known in the cryptocurrency industry, particularly in IT security and smart contract protocols. 1inch has also attracted institutional support from investors like Pantera Capital and Binance Labs, enhancing the project’s credibility.

From a technological standpoint, 1inch offers features that ensure both scalability and security. The platform operates on multiple blockchains (e.g., Ethereum, Binance Smart Chain, Polygon), which increases its accessibility and performance. It also implements anti-front-running mechanisms to protect users from unfair trading practices, and regular code audits by reputable firms (such as Consensys Diligence, OpenZeppelin) further increase trust in the project. With the Fusion Mode, the platform enables fee-free trading, using a matching algorithm for order execution. The project has also introduced the Chi Gas Token to reduce gas costs on Ethereum.

The 1INCH token (ERC-20) plays a crucial role in platform governance, granting holders voting rights over the project’s development direction. The token is also used for staking, with a total supply of 1.5 billion. The token distribution, which includes funds for community rewards, protocol development, and allocations for investors and the team, is transparent and publicly accessible.

1inch stands out against competitors such as Uniswap, SushiSwap, and Matcha by offering advanced algorithms that split transactions across multiple liquidity sources and lower transaction fees through gas optimization. Additionally, it supports a greater number of blockchain networks and additional functionalities, making it more flexible and user-friendly.

One challenge for 1inch lies in regulatory aspects, as the DeFi platform does not require identity verification (KYC/AML), which may pose issues in certain jurisdictions. The project has implemented geographic restrictions in sanctioned countries and warns users about applicable local regulations. Although 1inch does not publish traditional financial reports (common in DeFi), information about funding rounds and fund allocation is available, which enhances financial transparency.

Regular security audits, transparent code available on GitHub, community governance, and partial decentralization demonstrate the project’s commitment to transparency and security. However, it’s worth noting that control over key decisions still rests with the team, a characteristic typical of early-stage DeFi projects.

In summary, 1inch.io is a solid DeFi project with innovative solutions that enhance the efficiency and transparency of trading on decentralized exchanges. Investors interested in the DeFi sector may view 1inch as an attractive investment option, though regulatory risks remain an important factor to consider.

Basic aspects of the project

White Paper Analysis: Assessment of Key Technological and Business Goals

The goal of 1inch.io is to optimize transactions on decentralized exchanges by aggregating liquidity from various sources, which minimizes price slippage and fees for users. The main tool is the Pathfinder algorithm, which processes thousands of potential transaction routes to find the most profitable options. The Limit Order Protocol, in turn, allows users to place limit orders without intermediaries, supporting decentralized transactions. From a business perspective, 1inch.io aims to simplify access to DeFi and plans to expand into new markets through integration with multiple blockchain networks.

Team and Advisors Assessment

The founding team of 1inch, consisting of Sergej Kunz (CEO) and Anton Bukov (CTO), has significant experience in the IT industry and in working with smart contracts and security within DeFi. Sergej Kunz has a background as a senior developer and IT security specialist, while Anton Bukov has been specializing in DeFi protocol development for years. The team does not disclose specific advisors, which is not uncommon for DeFi projects that prioritize decentralization.

Blockchain Technology Evaluation: Scalability and Security

1inch supports multiple blockchain networks such as Ethereum, Binance Smart Chain, and Polygon, highlighting its interoperability. The project implements gas cost optimization, and its smart contracts are regularly audited by renowned firms such as Consensys Diligence and OpenZeppelin. Anti-front-running mechanisms protect users from unfair transactions, while innovative tools like Fusion Mode and Chi Gas Token allow for further reductions in costs and fees.

Tokenomics: Token Structure and Use Cases

The 1INCH token (ERC-20) is a key component of the ecosystem, enabling token holders to participate in protocol governance, staking, and integration with other DeFi services. The total token supply is 1.5 billion, with the distribution covering funds allocated to community growth, technology development, investors, and the team.

Competition Assessment

1inch competes in the market with projects like Uniswap (the largest decentralized exchange based on AMM), SushiSwap (a Uniswap fork with additional features), and Matcha (a DEX aggregator created by 0x Protocol). 1inch’s advantage lies in its advanced algorithm, which enables transaction cost optimization, and in its support for a greater number of blockchain networks.

Regulatory Analysis: Legal and Regulatory Challenges

As a DeFi platform, 1inch does not require identity verification (KYC/AML), which may pose regulatory challenges, especially in countries with stricter regulations. The project uses geographic restrictions in sanctioned countries and informs users of the need to comply with local regulations. Regulatory risk is high, but preventive measures help mitigate potential issues.

Security Audit: Code and Smart Contract Verification

The 1inch code is regularly audited by reputable firms such as Consensys Diligence, ChainSecurity, and CertiK, which increases the project’s security. Audits have shown no critical vulnerabilities, and the 1inch team quickly implements auditors’ recommendations. Additionally, the project runs a bug bounty program to encourage the community to identify potential issues.

Financial Transparency Assessment

As a decentralized DeFi project, 1inch does not publish traditional financial reports; however, its funding from reputable investors like Pantera Capital and Binance Labs enhances its credibility. The absence of any indications of financial manipulation and transparency in fund allocation demonstrate a responsible approach to financial management.

Field Investigations: Interviews and Operational Analysis

Due to the decentralized nature of 1inch, there are no available interviews with former employees, which is typical for DeFi projects that lack a traditional corporate structure. However, the project engages in open dialogue with users and regularly publishes updates on Twitter and Discord, indicating transparency.

Ownership Structure Analysis

The project’s founders, Sergej Kunz and Anton Bukov, are supported by institutional investors such as Pantera Capital and Galaxy Digital. The project has held funding rounds, and token distribution is publicly available, supporting transparency and trust in the project.

Cryptocurrency Investigations: Verification of Smart Contracts and Decentralization

The project’s code is public and audited, allowing community verification. The project aims for decentralization by granting token holders voting rights, although the team retains key control over platform development, which is common among early-stage DeFi projects.

Compliance Verification

1inch takes steps to reduce regulatory risk by implementing geographic restrictions and legal warnings. The platform enjoys support from reputable investors, suggesting no ties to suspicious entities. However, the lack of KYC/AML requirements may pose challenges in more restrictive countries.

Summary of Findings and Recommendations

1inch.io is a solid project with an experienced team, regularly audited technology, and support from reputable investors. The platform is innovative, efficient, and competes well in the DeFi market. The primary risks relate to potential regulatory changes, which require ongoing monitoring, but the project may be an attractive option for investors interested in the DeFi sector.

- Positive outlook – for investors interested in DeFi innovations.

- Regulatory caution – monitoring legal changes that could impact the platform’s operations.

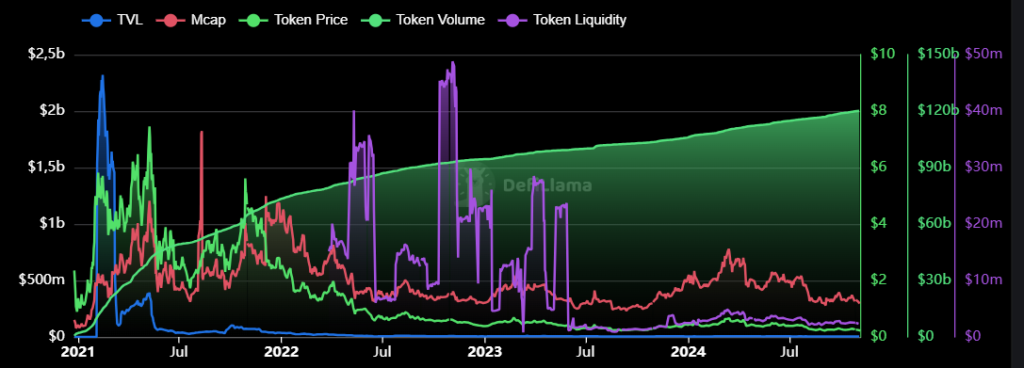

Data on various metrics

Source: Defillama

TVL (Total Value Locked) – marked in blue:

- This represents the total value locked in the 1inch ecosystem.

- We can see that in the initial phase of 2021, the TVL value increased sharply, reaching a peak above $2 billion, then declined just as quickly. It then fluctuated at lower levels for the remainder of the chart.

- Since 2022, TVL has remained relatively stable without major spikes, which might indicate a stabilization of funds locked within the project.

Mcap (Market Capitalization) – marked in red:

- This is the market capitalization of the 1inch project.

- Market cap increased steadily in 2021, reaching a peak around mid-2021, then gradually declined and stabilized.

- Since 2022, the market cap has been on a downward trend, with a more stable, lower level observed from mid-2023 onward.

Token Price – marked in green:

- The price of the 1inch token.

- The token price followed a similar trend to TVL, hitting high levels in 2021 before dropping to lower values.

- Since late 2022, the token price has gradually increased, reaching more stable values, suggesting a certain level of market interest stabilization in the 1inch token.

Token Volume – marked in light green:

- The trading volume of the 1inch token.

- Trading volume experienced significant increases and decreases, especially noticeable in 2021, and then gradually declined in 2022.

- Since 2023, trading volume has remained more stable but low, which might indicate reduced market interest in the token.

Token Liquidity – marked in purple:

- The liquidity of the token, or its availability in the ecosystem.

- Liquidity showed significant spikes, particularly from 2021 to 2023, likely due to higher trading activity and market fluctuations.

- From mid-2023 onward, token liquidity has dropped and remained at a low level, potentially indicating reduced supply or demand in the market.

General Conclusions:

- Rise and fall in popularity: The 1inch project experienced dynamic growth early on in 2021, with high TVL, market capitalization, liquidity, and trading volume. However, market interest later declined, leading to drops across all key metrics.

- Stabilization since 2023: Since the beginning of 2023, there has been a stabilization of TVL and market capitalization at lower levels, which may suggest that the project has found a base of investors or users, although liquidity and trading volume remain low.

- Potential Challenges: Reduced liquidity and trading volume could pose challenges for the 1inch project, as they indicate lower market interest in trading the token.

These conclusions suggest that the 1inch project has gone through a phase of initial growth, followed by stabilization, but now faces challenges in maintaining market interest and improving token liquidity.

Forensic Report: Analysis of the 1inch Project

Founding Team Analysis and Financial Connections

Sergej Kunz (CEO and Co-founder): Before founding 1inch, Sergej Kunz worked as a senior developer at companies like Porsche, specializing in IT security and smart contract audits. No publicly available information suggests his involvement in fraud or financial manipulation.

Anton Bukov (CTO and Co-founder): Involved in software development since 2002, with experience in smart contracts and DeFi protocols. There are no reports of his participation in illegal financial activities.

Financial Connections: 1inch has received backing from reputable investors such as Pantera Capital, Binance Labs, and Galaxy Digital. No available information indicates any unfavorable financial connections related to the team or the project.

Incidents of Concern

Cyberattack in August 2023: In August 2023, 1inch suffered a cyberattack in which hackers exploited a vulnerability in the Lottie Player library, leading to a supply chain attack. This attack compromised platform security, underscoring the need for continuous monitoring and security updates.

Technological Security Assessment

Security Audits: 1inch regularly subjects its smart contracts to audits by renowned firms such as Consensys Diligence, OpenZeppelin, and CertiK. These audits have shown no critical security vulnerabilities, and the team quickly implements auditors’ recommendations.

Bug Bounty Program: The platform runs a bug bounty program, encouraging the community to report potential issues, which enhances the overall security.

Potential Threats and Risk of Manipulation

Regulatory Risk: As a DeFi platform, 1inch operates in a legally uncertain environment. The lack of KYC/AML procedures may attract regulatory attention, potentially leading to restrictions or sanctions in the future.

Dependence on External Libraries: The August 2023 incident highlighted the risks associated with reliance on external libraries and tools. Using vulnerable components can compromise system integrity.

Potential “Rug Pull” Risk: While there is no evidence to suggest that the 1inch team is planning a “rug pull” scam, investors should be aware that in the DeFi world, such risks always exist, especially in highly decentralized projects.

Summary

The 1inch team has no known associations with fraud or financial manipulation. The platform places significant emphasis on technological security, conducting regular audits and engaging the community to identify potential threats. However, the August 2023 incident underscores the need for continuous monitoring and security updates in the rapidly evolving DeFi landscape. Investors should be mindful of potential regulatory risks and technological dependencies.

1inch Platform Technology Security Assessment

Security Audits

The 1inch platform regularly subjects its smart contracts to audits by reputable blockchain security firms. These include:

- OpenZeppelin: Known for providing tools and security audits for smart contracts, especially within the Ethereum ecosystem.

- ConsenSys Diligence: A branch of ConsenSys focused on security audits and smart contract code analysis.

- SlowMist: A Chinese company specializing in blockchain security, offering audits and monitoring services.

- Haechi Labs: A South Korean firm that provides smart contract audits and security consulting.

- CoinFabrik: A provider of smart contract audit services and blockchain software development.

- CertiK: A firm offering formal verification of smart contracts and security audits.

- Hacken: A European company involved in security audits and penetration testing within the blockchain ecosystem.

- Scott Bigelow: An individual expert in smart contract security.

- MixBytes: A company providing smart contract audits and blockchain software development.

- Chainsulting: A German firm specializing in smart contract audits and blockchain consulting.

These audits aim to identify potential security vulnerabilities and ensure the integrity and reliability of the platform’s source code. The audit results are publicly accessible, demonstrating 1inch’s commitment to transparency.

Bug Bounty Program

1inch runs a bug bounty program that encourages security researchers and ethical hackers to report any discovered vulnerabilities in the system. This program offers financial rewards based on the severity of the reported vulnerability. This initiative not only enhances platform security but also engages the community in its continuous improvement.

Attack Prevention Mechanisms

The 1inch platform implements advanced mechanisms to protect against various types of attacks:

- Front-running Protection: Technology to safeguard users from front-running attacks, where malicious actors attempt to preempt users’ transactions for profit.

- Limit Order Protocol: Allows users to set limit orders in a decentralized way, eliminating the need for intermediaries and reducing the risk of manipulation.

Key and Access Management

1inch adopts a decentralized approach to key management, meaning that users retain full control over their funds. The platform does not store users’ private keys, which minimizes the risk of fund theft in case of a potential security breach of 1inch’s servers.

Updates and Incident Response

The 1inch team regularly updates the platform, implementing security patches and new features. In the event of a vulnerability detection, the team responds promptly by deploying necessary fixes and informing the community about the actions taken.

Conclusion

The 1inch platform demonstrates high standards in technology security. Regular audits by reputable firms, an active bug bounty program, and the implementation of advanced security mechanisms highlight the team’s commitment to user safety. However, as with any DeFi platform, users should exercise caution and be aware of the potential risks associated with using blockchain-based financial services.

1inch Partners and Investor

1inch Network is a top DEX aggregator in the DeFi ecosystem, collaborating with numerous partners and investors to expand its functionality and reach.

1inch Network Partners:

1inch integrates with many key players within the blockchain ecosystem, enhancing its capabilities and accessibility. Some of its main partners include:

- Polygon: Provides scalable solutions for transactions.

- Metamask: A popular cryptocurrency wallet.

- BNB Chain: A blockchain created by Binance.

- Crypto.com: A cryptocurrency platform offering a variety of services.

- Trust Wallet: A secure mobile wallet.

- Chainlink: A provider of decentralized oracles.

- Coinbase: One of the largest cryptocurrency exchanges.

- Binance Labs: The investment arm of Binance.

A complete list of partners is available on the official 1inch website.

1inch Network Investors:

1inch has attracted attention from several reputable investors within the cryptocurrency industry. Key investors include:

- Pantera Capital: An investment fund focused on blockchain technology.

- Binance Labs: Binance’s investment branch supporting blockchain projects.

- Galaxy Digital: An investment firm specializing in digital assets.

- Amber Group: A global company providing financial services in cryptocurrency.

These partnerships and investments highlight the strong support 1inch has within the blockchain and DeFi ecosystems.

Analysis of the 1inch Project Using Arkham Intelligence Tools

1inch is a leading decentralized exchange (DEX) aggregator that optimizes transactions by integrating liquidity from various sources. Leveraging Arkham Intelligence tools, an in-depth analysis of 1inch’s activity within the blockchain ecosystem was conducted.

Liquidity Analysis:

Using Arkham, the primary sources of liquidity utilized by 1inch were identified. The platform aggregates liquidity from numerous DeFi protocols, such as Uniswap, SushiSwap, and Balancer, allowing it to offer competitive prices and minimize price slippage for users.

Transaction Monitoring:

Analysis of large transactions conducted via 1inch revealed that the platform is frequently used by “whales” to execute significant orders. Through advanced routing algorithms, 1inch effectively breaks large transactions into smaller parts, executing them across multiple DEXs, which minimizes market impact and reduces transaction costs.

Identification of Partnerships and Integrations:

Smart contract interaction analysis indicates close collaboration between 1inch and various DeFi protocols. Integration with platforms like Aave, Compound, and Yearn Finance enables users to access additional services, such as lending and yield farming, without leaving the 1inch ecosystem.

Security and Audits:

Data from Arkham confirms that 1inch regularly subjects its smart contracts to security audits by reputable firms, including ConsenSys Diligence and OpenZeppelin. Additionally, the platform has implemented anti-front-running mechanisms, protecting users from unfair market practices.

Conclusions:

The use of Arkham Intelligence tools provided a comprehensive view of 1inch’s operations within the DeFi ecosystem. The platform stands out for its high liquidity, advanced transaction mechanisms, and strong partnerships with other protocols. Regular audits and implemented security mechanisms further enhance user trust, positioning 1inch as a reliable tool in the world of decentralized finance.

Source: https://platform.arkhamintelligence.com/

Summary

1inch is a decentralized cryptocurrency exchange aggregator (DEX) that enables users to optimize transactions by aggregating liquidity from various sources. The platform regularly subjects its smart contracts to audits conducted by reputable firms such as OpenZeppelin, ConsenSys Diligence, and CertiK, demonstrating its commitment to maintaining a high level of security. Additionally, 1inch runs a bug bounty program, encouraging the community to report potential security vulnerabilities.

In August 2023, the platform fell victim to a cyberattack in which hackers exploited a vulnerability in the Lottie Player library, leading to a supply chain attack. This incident highlights the importance of continuous monitoring and security updates within the rapidly evolving DeFi environment.

The founding team, including Sergej Kunz and Anton Bukov, has a strong background in the technology industry and is not associated with any known fraud or financial manipulation. However, as with any DeFi project, there are risks associated with potential regulatory changes and technological dependencies.

Potential Risks for Investors:

- Regulatory Risk: The absence of KYC/AML procedures on the 1inch platform may attract regulatory attention, which could lead to restrictions or sanctions in the future.

- Dependence on External Libraries: The August 2023 incident highlighted the risks related to relying on external libraries and tools. Using vulnerable components can compromise the system’s integrity.

- Potential “Rug Pull” Risk: Although there is no evidence to suggest that the 1inch team is planning a “rug pull” scam, investors should be aware that such risks always exist in the DeFi space, particularly with projects that are highly decentralized.

- Technological Risk: Despite regular audits, the possibility of unknown security vulnerabilities remains, which could potentially be exploited by malicious actors.

- Liquidity Risk: In the event of sudden market changes or reduced interest in the platform, liquidity issues may arise, making it difficult to execute transactions at expected prices.

For the average investor, 1inch appears to be a relatively safe project given its commitment to security and transparency. Nevertheless, investors should be aware of the inherent risks in the DeFi sector and keep an eye on potential changes in regulatory and technological aspects affecting the platform.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Source:

https://blog.1inch.io/1inchs-aml-screening-tools-for-web3-security/

https://blog.1inch.io/the-1inch-wallet-five-layers-of-security/

https://blog.1inch.io/1inch-security-and-deterrent-measures/

https://www.av-test.org/en/news/cyber-incidents-in-numbers-year-2023/

https://blog.checkpoint.com/research/check-point-research-2023-the-year-of-mega-ransomware-attacks-with-unprecedented-impact-on-global-organizations/

https://www.bleepingcomputer.com/news/security/the-biggest-cybersecurity-and-cyberattack-stories-of-2023/

https://www.techmonitor.ai/technology/cybersecurity/biggest-cyberattacks-2023

https://www.itgovernance.eu/blog/en/cyber-attacks-and-data-breaches-in-review-august-2023

https://www.cshub.com/attacks/news/the-biggest-cyber-security-incidents-in-august-2023

https://www.cm-alliance.com/cybersecurity-blog/august-2023-recent-cyber-attacks-data-breaches-ransomware-attacks

https://www.sentinelone.com/blog/endpoint-identity-and-cloud-top-cyber-attacks-of-2023-so-far/

https://blog.1inch.io/how-1inch-ensures-the-security-of-users-funds/

https://1inch.io/

https://news.crunchbase.com/unicorn-company-list/

https://news.crunchbase.com/ma/pe-leads-startup-ma-trends-ai-biotech/

https://platform.arkhamintelligence.com/

https://www.canva.com/