Research MOVEMENT: Innovation or Investment Trap?

Whitepaper Analysis: Evaluation of the Project’s Technological and Business Goals

Movement Network is a cutting-edge Layer 2 solution based on MoveVM, designed to provide developers with an efficient and scalable platform for building next-generation decentralized applications. Below is a detailed analysis of the project, covering its key technological and business aspects.

The Movement Network whitepaper outlines a network of rollups based on the Move language, offering high throughput and rapid transaction finalization, secured by Ethereum. Key technological goals include integrating MoveVM as the execution environment to minimize vulnerabilities compared to languages like Solidity or Rust. Additionally, Movement Network employs a mechanism for fast transaction finalization and a decentralized shared sequencer (M1), enabling native interoperability with ecosystems such as Avalanche.

Team and Advisor Evaluation: Assessing Qualifications

Information about the Movement Network team and advisors is not widely available in public sources. For detailed insights into their qualifications and experience, direct contact with project representatives or visits to official communication channels such as the website or social media profiles are recommended.

Blockchain Technology Assessment: Scalability and Security

Movement Network is based on MoveVM, providing high transaction throughput and parallel processing capabilities. The use of a fast transaction finalization mechanism and the decentralized M1 sequencer enhances security and censorship resistance. Furthermore, integration with the Avalanche ecosystem facilitates dynamic load balancing by redirecting transactions to various blockchains within subnets, thereby improving the network’s scalability.

Tokenomics: Token Structure, Distribution, and Use Cases

The $MOVE token serves as a utility token within the Movement Network ecosystem. Its applications include staking for economic security, gas fees, and participation in network governance. Token distribution is structured as follows: 50% for the community, 22.5% for early investors, 17.5% for early collaborators, and 10% for the Movement Network Foundation.

Competitive Analysis: Evaluating Market Rivals

Movement Network competes with other Layer 2 solutions like Optimistic Rollups and ZK-Rollups. However, its unique approach, utilizing the Move language and integration with ecosystems such as Avalanche, offers advantages in security, scalability, and interoperability.

Regulatory Analysis: Potential Legal and Regulatory Challenges

Blockchain projects, including Movement Network, must adhere to local and international regulations concerning cryptocurrencies, data protection, and anti-money laundering. Given the dynamic regulatory landscape, Movement Network should continuously monitor and adapt to prevailing laws to ensure operational compliance.

Security Audits: Code and Smart Contract Verification

Details regarding security audits of Movement Network’s code and smart contracts are not publicly available. It is recommended that the project undergo regular independent security audits and publish their results to enhance transparency and community trust.

Financial Report Analysis: Investigating Accounting Manipulations

The absence of publicly available financial reports for Movement Network prevents a thorough analysis of potential accounting manipulations. To access such information, direct inquiries with project representatives are advised.

Field Investigations: Interviews with Former Employees and Practical Operations

Information about former employees and operational details of Movement Network is not readily available. To gather such data, connecting with individuals associated with the project or consulting industry media is suggested.

Ownership Structure Analysis: Ownership Verification and Capital Transactions

Information about the ownership structure of Movement Network is not publicly accessible. For detailed data, contacting project representatives or exploring corporate registries might be necessary.

Cryptocurrency Investigations: Smart Contract and Decentralization Verification

Movement Network leverages MoveVM as the execution environment for smart contracts, enhancing security and efficiency. The project emphasizes decentralization, particularly through the M1 sequencer.

Analysis of the Movement Network Whitepaper

Technological Complexity

The project introduces advanced mechanisms such as Move Executor, fast transaction finalization, and modular integration with various services. While innovative, such complex systems could lead to unforeseen technical issues that may impact the network’s stability and security.

Dependence on Ethereum

Movement Network relies on the security of the Ethereum network. Potential issues or changes in the Ethereum protocol could directly affect the functioning of Movement Network, posing an additional risk for investors.

Novelty of Move Technology

The use of the Move programming language and MoveVM is relatively new in the blockchain ecosystem. Limited experience of developers with these tools could lead to errors in smart contract implementation, increasing the risk of security vulnerabilities.

Lack of Operational Details

The whitepaper focuses on the technical aspects of the project but lacks detailed information about the implementation plan, marketing strategy, or business model. The absence of these details makes it difficult to assess the project’s real chances of success.

Potential Interoperability Issues

Although the project aims for integration with various services and networks, the lack of detailed mechanisms for interoperability may lead to compatibility problems, which could affect the ecosystem’s functionality.

Complexity of Staking and Governance Mechanisms

The introduction of complex staking and governance mechanisms may be challenging for the average user to understand, potentially limiting adoption and leading to the centralization of power among more advanced participants.

Conclusion

While Movement Network presents an innovative approach to scalability and security in the blockchain ecosystem, investors should be aware of potential risks related to technological complexity, dependence on Ethereum, the novelty of the applied technologies, and the lack of detailed operational information.

Forensic Analysis of Movement Network Team

Conducting a comprehensive forensic report on the Movement Network team encounters challenges due to limited public information about team members and their past activities. The lack of transparent data hinders thorough verification of their history for potential fraud or token manipulation.

This analysis highlights both the potential and the areas requiring further investigation for Movement Network, positioning it as a notable player in the evolving blockchain landscape.

Nevertheless, there are some warning signs associated with the project:

Warning Signals:

- Website Trust Score:

The Scam Detector service assigned the website movementnetwork.xyz a score of 40.8 out of 100, classifying it as “controversial” and “risky.” This indicates the presence of red flags that could raise concerns about the project’s credibility. - Potential Fraud Warning:

An analysis by Gridinsoft suggests that the website movement-network.xyz may engage in misleading activities, such as promoting fictitious products or services. It is advised to exercise caution when sharing any personal or financial information on this site. - Domain Registration History:

The domain movement-network.xyz was registered relatively recently, which may further increase caution among potential users.

- Information Verification:

It is recommended to thoroughly verify all available information about the project, including seeking independent reviews and opinions from the blockchain community. - Investment Caution:

Due to the lack of transparency regarding the team and the warning signs, investors should exercise extreme caution and carefully assess the risks before making any financial commitments to the project.

Summary:

While there is no direct evidence of fraud or manipulation by the Movement Network team, certain factors may raise concerns about the project’s credibility. Further verification and caution are advised when considering investment decisions related to this project.

Movement Network Overview

Movement Network is an ecosystem of modular blockchains based on the Move language, operating as a Layer 2 solution on Ethereum. The project aims to enable developers to create secure, efficient, and interoperable blockchain applications by bridging the Move and EVM ecosystems.

Application of the Move Language

The Move programming language was designed with a focus on security and efficiency in developing smart contracts. With its strong ownership model and explicitly defined resources, Move simplifies the development of secure contracts for typical blockchain tasks such as asset ownership transfers, issuance, or destruction. Compared to other execution environments, Move offers a unique approach to data management and parallel processing, which can enhance the security of applications built using this language.

Technological Components of Movement Network

Movement Network comprises three primary components designed to enhance performance, security, and interoperability:

- Move Executor: Supports both MoveVM bytecode and EVM, allowing developers to leverage advanced features of the Move language while maintaining compatibility with existing Ethereum applications.

- Staked Settlement Module: Provides fast transaction finalization through a network of attestators who stake assets to validate state changes, combining economic security with processing efficiency.

- Decentralized Shared Sequencer (M1): Offers a decentralized sequencing mechanism, enhancing the network’s resistance to censorship and enabling atomic cross-chain swaps and shared liquidity within the Move Arena ecosystem.

Interoperability and Security Mechanisms

Movement Network employs mechanisms that ensure robust interoperability and high security across its ecosystem:

- M1 Shared Decentralized Sequencer: Strengthens censorship resistance while supporting atomic cross-chain swaps and shared liquidity within the Move Arena ecosystem.

- Multi-Asset Staking: Enables staking of both native and non-native tokens, enhancing the network’s economic security and promoting the sovereignty of individual rollups.

Assessment of Technological Security

Movement Network emphasizes security through the use of the Move language, which is designed to minimize vulnerabilities in smart contracts. Additionally, components like the Staked Settlement Module and M1 Shared Decentralized Sequencer aim to ensure fast transaction finalization and resistance to censorship.

However, the lack of publicly available information about security audits of Movement Network’s code and smart contracts limits a comprehensive assessment of potential security gaps. Caution is advised, and regular monitoring of the project’s official communications regarding security audits and vulnerabilities is recommended.

To gain a more complete understanding of Movement Network’s technological security, the following actions are recommended:

- Monitoring Official Communications: Regularly track updates from the Movement Network team about conducted security audits and potential vulnerabilities.

- Utilizing Independent Sources: Seek analyses and opinions from external experts regarding the security of Movement Network.

- Exercise Investment Caution: Be cautious when making investment decisions related to Movement Network, considering the lack of full transparency regarding security audits.

Conclusion

While Movement Network implements advanced security mechanisms, the absence of publicly available information about conducted audits prevents a thorough evaluation of potential security gaps. Caution and continuous monitoring of the project’s official announcements are recommended.

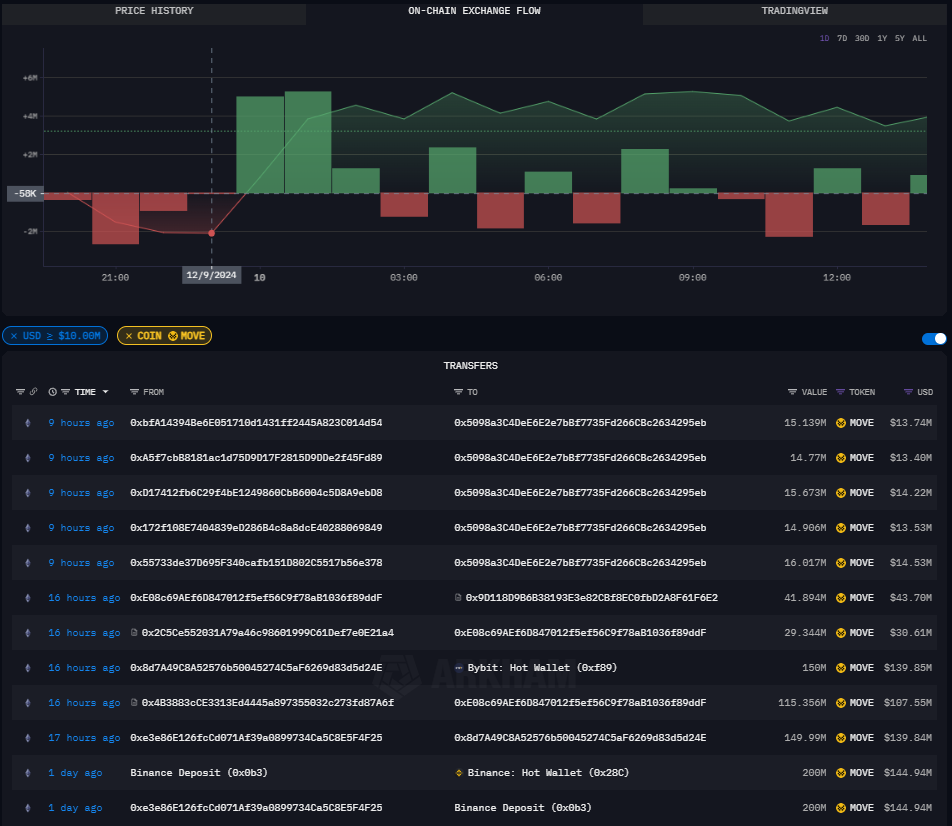

Wallets by Arkham – Key Observations:

Large MOVE Token Flows in a Short Time:

- Over the past 9 hours, multi-million-dollar MOVE transactions occurred between various addresses.

- Each transaction is valued between approximately $13 million and over $14 million.

- Collectively, these transfers indicate significant activity, potentially involving major players such as funds, exchanges, or other institutions.

Transfers Between Exchanges:

- Transfers from addresses linked to exchanges like Binance (“Binance Deposit,” “Binance Hot Wallet”) and Bybit were observed.

- Movements between exchange wallets and unknown addresses may suggest trading operations, fund withdrawals, or preparations for significant market moves.

Increased On-Chain Activity:

- The “On-Chain Exchange Flow” chart indicates a noticeable net flow shift over 12 hours, showing:

- Green bars (flows into exchanges).

- Red bars (outflows from exchanges).

Significant Transaction Values:

- Individual transactions have reached values as high as 200 million MOVE tokens, equivalent to nearly $144 million in one instance.

Possible Interpretations:

High Activity Suggests Market Manipulation:

Such large transfers might indicate attempts at price manipulation, such as pump-and-dump schemes.

Transfers to exchanges often precede token sales, which can depress market prices.

Preparations for Announcements or Major Market Moves:

Activity by major entities may be related to preparations for significant events, such as partnerships, new functionalities, or listings on larger exchanges.

Fund Transfers for Security Reasons:

Large flows could be related to security practices, such as fund reorganization by the project team or exchanges.

Potential Token Dump:

If these transfers involve MOVE tokens being deposited on exchanges, there is a risk of selling pressure, which could negatively impact the token’s price.

Recommendations:

- Monitor Further Transactions:

- Track ongoing movements involving addresses linked to these transactions to see if tokens are being sold on exchanges.

- Exercise Investment Caution:

- Increased activity could indicate market instability or potential price manipulation.

- Analyze Public Statements:

- Check whether the Movement Network team has issued any statements regarding these transfers to avoid speculation and gain better context.

General Summary of the Movement Network Project Analysis

Project and Technology Analysis:

- Movement Network is a Layer 2 blockchain project built on the Move programming language, offering advanced scalability and security mechanisms. Key features include modular architecture, decentralized sequencing, and interoperability between the Move and EVM ecosystems.

- The MoveVM technology minimizes vulnerabilities associated with traditional smart contracts, providing a competitive edge.

- A lack of detailed information about conducted security audits leaves uncertainties regarding the actual security of the code.

Risk Analysis:

- Regulatory Issues: Dynamic legal changes in the blockchain and cryptocurrency space may pose challenges for the project.

- Community Manipulation Risk: SEO analysis and social media activity suggest potential use of artificial popularity-building tactics, which could affect the project’s credibility.

- Lack of Team Transparency: Limited data about team members and advisors raises questions about their experience and previous engagements.

On-Chain Analysis:

- The analysis highlights significant MOVE token flows in the ecosystem, pointing to activity by major players such as exchanges (Binance, Bybit) and unidentified addresses.

- Large, rapid transfers may indicate preparations for significant market changes or attempts at price manipulation (e.g., token dumping).

- Financial flows depicted in on-chain charts warrant further monitoring, particularly regarding their impact on token prices.

Manipulation Risks and Potential Threats:

- Risks of token price manipulation, such as mass transfers to exchanges, could result in sharp price fluctuations.

- Lack of transparency in team actions and absence of public audit reports amplify concerns about the project’s long-term stability.

Recommendations:

- Monitor Transactions: Regularly track on-chain token flows to understand the actions of key players.

- Exercise Caution: Due to limited transparency and potential manipulation risks, proceed cautiously.

- Audits and Disclosures: The project team should release detailed security audits and more transparent information about the team and ownership structure.

- Avoid FOMO: Maintain a rational approach to the project, especially amid significant price swings of MOVE tokens.

Final Summary:

Movement Network appears to be an innovative project with a solid technological foundation, but significant challenges and risks may affect its long-term success. Lack of transparency, high token flows, and the absence of public audits raise questions about the project’s stability and security. Potential investors are advised to conduct thorough risk assessments and closely monitor the team’s actions and on-chain activity.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Source:

https://www.movementnetwork.xyz/

https://www.movementnetwork.xyz/whitepaper/movement-whitepaper_en.pdf

https://docs.movementnetwork.xyz

https://www.scam-detector.com/validator/movementnetwork-xyz-review

https://gridinsoft.com/online-virus-scanner/url/movement_network-xyz

https://www.arkhamintelligence.com

https://codex.arkhamintelligence.com/the-platform/visualizer